Important Announcement

- Protect Your Account from SMS Scams with Fake link

- Launch of Multi Share Class for Reksa Dana Schroder USD Bond

- Information on Savings Interest Rate Adjustment

- Launch of Multi Share Class for Reksa Dana Schroder USD Bond

- Implementation of VAT on Mutual Fund Transaction Fees

- Temporary closing schedule MAGOLD

- New Location Branch Office Makassar

- Changes in VAT for Mutual Fund Transaction Fees

- Payment Services in Bayar & Beli - Orange TV,Paypro,XL Tunai

- Addition Types of Authorization of Instruction via Telephone

- Temporary Closing Switching of Manulife Syariah Golden Asia

- Medan Diponegoro branch office will be moved

- Terms & Conditions for Opening & Managing Individual Account

- Deactivated Spending Tracker on digibank Application

- Operational activity of PT Bank DBS Indonesia

- Some Payment Service in Bayar & Beli Feature will be Deactiv

- Operational activity of PT Bank DBS Indonesia on Eid Holiday

- Operational activity of PT Bank DBS Indonesia

- DBS Indonesia Branches Operational Hours

- Announcement of Green Savings Account Interest Rate Adjustme

- System Maintenance Information

- Bayar & Beli feature in the digibank application

- System Maintenance Information

- Terms and Conditions for Opening and Managing Accounts

- Temporary closing schedule switching transactions "MAGOLD"

- Comprehensive & seamless financial access on digibank App

- Operational Activity of PT Bank DBS Indonesia

- Announcement for Pancasila and Vesak Day 2023

- Announcement for Savings Account Interest Rates Adjustment

- Operational Activity on 19th -25th April 2023

- New Menu and Function in CCTR IVR

- Dormant Fee Notification

Operational activity of PT Bank DBS Indonesia (Bank DBS)

Dear Valued Customers,

Please be advised. Due to Seclusion Day (Nyepi) and Eid Al Fitr 2025, the operational activity of PT Bank DBS Indonesia (Bank DBS) will be closed on Friday, 28 March 2025 – Monday, 7 April 2025.

The branches will be re-opened on Tuesday, 8 April 2025.

PT Bank DBS Indonesia wishes you Happy Seclusion Day and Eid Mubarak.

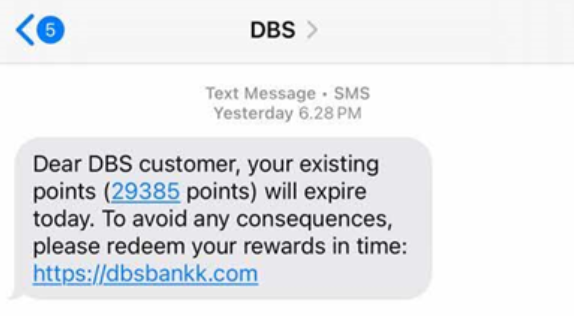

Protect Your Account from SMS Scams with Fake Point Redemption Links

Beware of Point Redemption Scams!

Fraudulent point redemption schemes are becoming more common. One common tactic is for scammers to send SMS messages pretending to be from a bank, containing false information as shown in the example below.

What Are the Scammers’ Intentions?

- Redirecting You to a Fake Website – Scammers trick you into entering sensitive information such as your PIN, credit/debit card number, CVV/CVC, and One-Time Password (OTP).

- Gaining Control of Your Bank Account – If scammers obtain your banking details, they can access and misuse your account.

How to Protect Yourself from Scams:

- Verify Before Acting – Always check banking services, offers, or promotions through the bank’s official contact, social media, or website.

- Be Cautious of Unknown SMS Messages – Delete any suspicious banking-related messages immediately.

- Avoid Clicking Suspicious Links – Never click on links that ask for personal data or redirect you to unofficial websites.

- Keep Your Banking Information Private – Never share your PIN, OTP, or other sensitive account details.

If you receive a suspicious SMS, contact PT Bank DBS Indonesia ("Bank") through its official channels. Stay alert and stay safe!

- DBSI Customer Center: 1500 327 or +6221 29852888 (from outside Indonesia) - specifically for receiving Customer calls.

- digibank by DBS Application: Live Chat24/7 via digibot (chat icon on the top right).

- WhatsApp Bisnis Bank DBS Indonesia: +62 85815003270 (specifically for sending one-way messages from the Bank to Customers)

- Email: Using the official domain @dbs.com

- Facebook: DBS And digibank by DBS

- Instagram: @dbsbankid and @digibankid

- YouTube: DBS Indonesia and digibank by DBS

- TikTok: @digibankid

Launch of Multi Share Class for Reksa Dana Schroder USD Bond Fund

Thank you for your support by becoming a customer of PT Bank DBS Indonesia (“DBSI”).

Referring to the previous notification regarding the “Launch of Multi Share Class for Reksa Dana Schroder USD Bond Fund”, it is hereby informed that effective starting March 10, 2025 DBSI will only distribute Schroder USD Bond Fund Class I. For customers who previously owned Schroder USD Bond Class A, as of March 10, 2025 the ownership unit will change to Schroder USD Bond Class I, with dividend payout feature.

In regards with this change implementation, the “KSEI AKSes Facility” will record a switching transaction from Schroder USD Bond Class A to Schroder USD Bond Class I on March 10, 2025.

Thus, this information is conveyed. If you need further information, please contact the 24-hour DBSI Customer Center service at 1500 327.

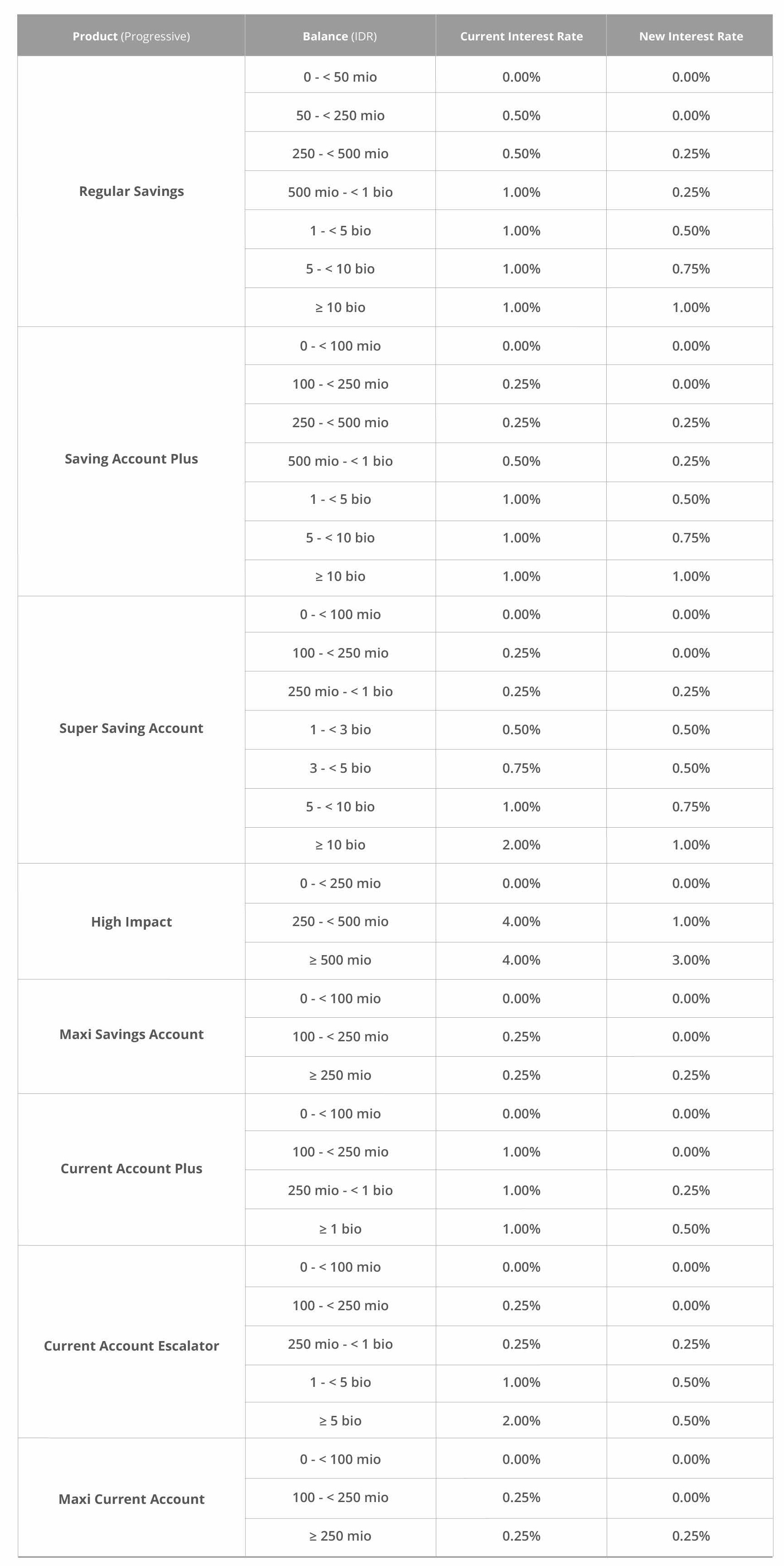

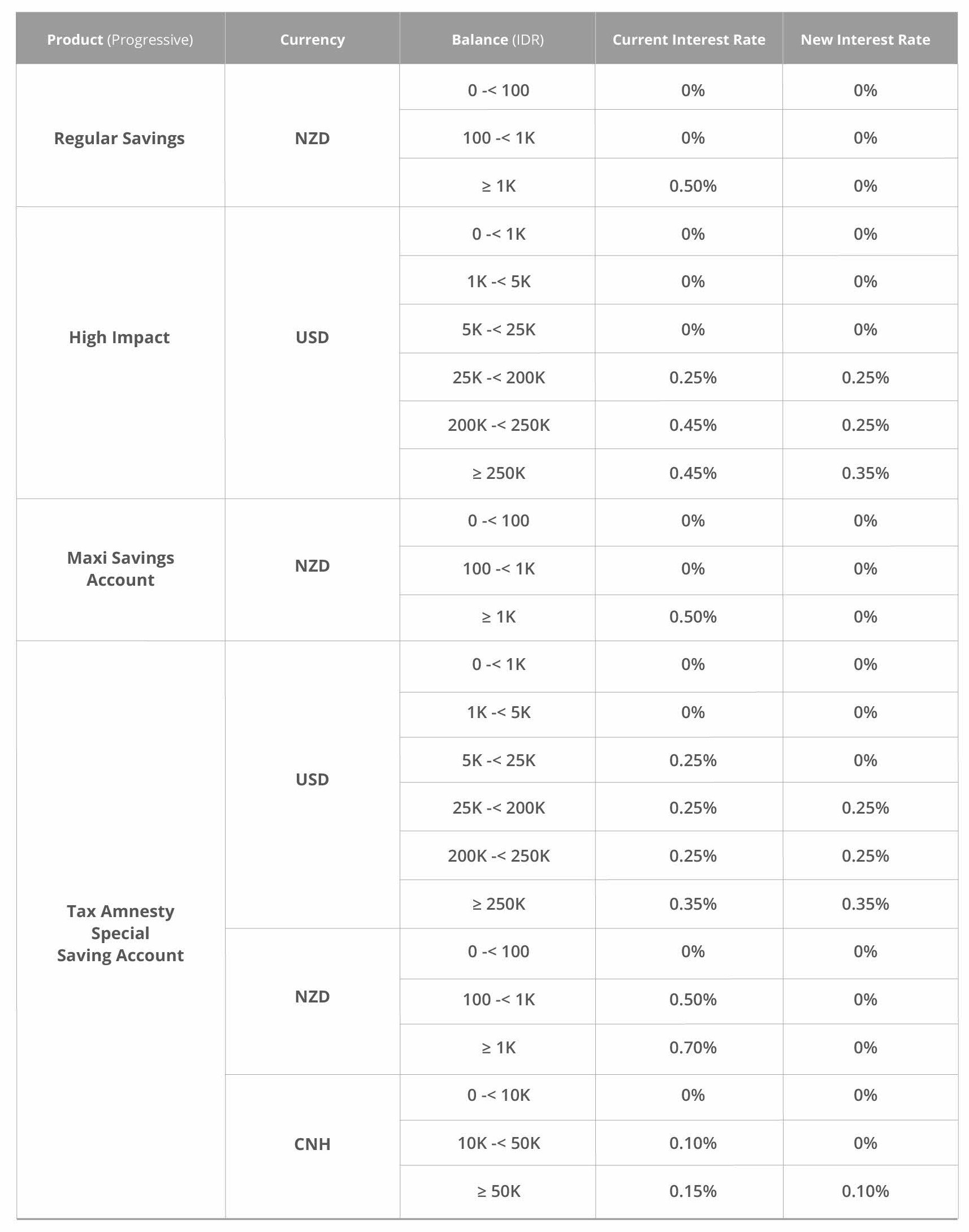

Information on Savings Interest Rate Adjustment

As part of our commitment to continuously optimize our services, we would like to inform you about the adjustment to the savings interest rate, which will be effective from 1 March 2025 with the following details:

|

Product Name |

Balance (IDR) |

New Interest Rate* (Effective 1 Mar 2025) |

|---|---|---|

|

Regular Savings, Saving Account, and Super Saving Account |

IDR 0 to IDR 250 million |

0.00% p.a |

|

IDR 250 million to IDR 1 billion |

0.25% p.a |

|

|

IDR 1 billion to IDR 10 billion |

0.50% p.a |

|

|

IDR 10 billion to IDR 50 billion |

0.75% p.a |

|

|

≥ IDR 50 billion |

1.00% p.a |

|

|

Maxi Saving Account (FFD) |

All balance tiers |

0.00% p.a |

|

Tabungan Maxi |

All balance tiers |

2.50% p.a |

*)Interest rates are subject to change at any time in accordance with interest rate guaranteed by LPS and will be informed through the Bank's channel. The above interest rates is valid for Treasures and Treasures Private Client customers

Continue to grow your balance to enjoy the best interest rate.

For more information, please contact your Relationship Manager or DBSI Customer Centre at 1500327 or +6221 298 52800 (from overseas).

Launch of Multi Share Class for Reksa Dana Schroder USD Bond Fund

Thank you for your support by becoming a customer of PT Bank DBS Indonesia (“DBSI”).

Referring to the notification from PT Schroder Investment Management Indonesia ("PT SIMI") No. 22931/DT/112024 dated 14 November 2024 regarding the Provision of share class A and I in the Schroder USD Bond Fund, we inform you that PT SIMI as the Investment Manager of the Schroder USD Bond Fund ("Mutual Fund") has implemented multi share class for Mutual Funds effective since 13 January 2025 with the following details:

- Share Class A (Accumulation): This is the current share class of the Mutual Fund, where investment results are reinvested to seek capital growth, and there is no dividend distribution to Unit Holders.

- Share Class I (Income): This is the new share class, which will distribute dividends regularly to Unit Holders.

In connection with the implementation of the multi share class above, we inform you that effective since 10 March 2025, Bank DBS Indonesia will only distribute Schroder USD Bond Fund class I, namely Mutual Funds that have a dividend distribution feature. Thus, effective from 1 March 2025, the Participation Unit Holders of Schroder USD Bond Fund Class A at Bank DBS Indonesia automatically become Participation Unit Holders of Schroder USD Bond Fund Class I.

This information is conveyed. If you need further information, please contact the 24-hour DBSI Customer Center service at 1500 327.

Implementation of VAT on Mutual Fund Transaction Fees - Effective January 1, 2025

Referring to the Minister of Finance Regulation PMK No 131 Year 2024, concerning “Value-Added Tax Treatment on the Import and Delivery of Taxable Goods, the Provision of Taxable Services, as well as the Utilization of Intangible Taxable Goods and Taxable Services from Outside the Customs Area within the Customs Area,” which takes effect on January 1, 2025, the following outlines is the applicable calculation scheme for VAT on Mutual Fund Transaction Fees.

- The VAT Payable calculation is as follows:

Tax Base

:

Other Value (11/12 x Mutual Fund Transaction Fee)

VAT Tariff

:

12%

VAT Calculation

:

11/12 x Mutual Fund Transaction Feex 12%

- Simulation of VAT Payable calculation for Mutual Fund Transaction Fee:

Transaction Type

:

Subscription / Purchase

Transaction Amount

:

IDR 1,000,000,000

Transaction Fee

:

1%

Transaction Fee Amount

:

IDR 10,000,000

Other Value Tax Base

:

IDR 9,166,667

calculated from IDR 10,000,000 x 11/12

VAT Tariff

:

12%

VAT Calculation

:

IDR 1,100,000

calculated from IDR 9,166,667 x 12%

Effective VAT Rate

:

11%

Calculated from IDR 1,100,000/IDR 10,000,000

Temporary Closing Schedule MAGOLD

Dear Valued Customer,

Referring to the notification provided by PT Manulife Aset Manajemen Indonesia as the Fund Manager, it is hereby informed the temporary closing schedule switching transactions of Reksa Dana Syariah Manulife Saham Syariah Golden Asia Dolar AS (“MAGOLD”) product during the period January 23, 2025 to February 3, 2025 (the “Period”).

|

Date |

Transaction Type |

NAV Date |

Settlement Date |

|---|---|---|---|

|

22-Jan-25 |

Subscription |

22-Jan-25 |

23-Jan-25 |

|

22-Jan-25 |

Switching |

22-Jan-25 |

23-Jan-25 |

|

22-Jan-25 |

Redemption |

22-Jan-25 |

29-Jan-25 |

|

23 Jan - 3 Feb 25 |

Subscription & Redemption |

Transaction proceed as usual |

|

|

23 Jan - 3 Feb 25 |

Switching |

Temporary Closed |

|

|

4-Feb-25 |

All transaction |

Transaction proceed as usual |

|

This temporary closure is due to the closing of stock exchanges in China, where most of the MAGOLD securities portfolio will not be traded from January 28,2025 – February 2 ,2025, to celebrate the Lunar New Year. Subscription and redemption transactions of Participation Units MAGOLD proceed as usual during the period.

This applicable for all transaction channels & all Selling Agents.

This notice advertisement has been published in Website PT Manulife Aset Manajemen Indonesia https://www.manulifeim.co.id/informasi/pengumuman.html

Thank you.

New Location Branch Office Makassar

Dear Valued Customer,

Thank you for your support and trust to PT Bank DBS Indonesia (“Bank DBS Indonesia”). We always strive to continuously improve the quality of our services, one of which is by taking strategic steps to ensure maximum business growth opportunities.

We are pleased to inform you that effective 3 February 2025, all transactional activities at Bank DBS Indonesia Makassar branch office, located at Jl. Haji Bau No.36, will be moved to the new branch location at:

Bank DBS Indonesia Kantor Cabang Makassar

Jl. DR Ratulangi No. 2

Makassar- Sulawesi Selatan

For your convenience during the transition period, the current Bank DBS Indonesia Makassar branch Office will continue to serve your banking needs until 31 January 2025 from 08:30 – 15:30 WITA. On the next working day, we welcome you to experience our banking services at the new location of Bank DBS Indonesia Makassar branch office.

Should you require further assistance, please contact your Treasures Relationship Manager or DBSI Customer Centre 1500 327. For corporate clients, please contact DBSI BusinessCare at 1500 380.

Thank you and we look forward to serving you better in the greatly improved office surroundings.

Yours faithfully,

PT Bank DBS Indonesia

Changes in VAT for Mutual Fund Transaction Fees – Effective January 1st 2025

Dear Valued Customer,

Referring to Law No. 7 of 2021 concerning Harmonization of Tax Regulations, it is stated in Chapter IV- Value Added Tax - article 7 paragraph (1) Value Added Tax Rates are:

- 11% (eleven percent) which will take effect on 1 April 2022;

- 12% (twelve percent) which will take effect no later than 1 January 2025

Based on this regulation, effective 1 January 2025, the VAT upon Mutual Fund transaction fees debited that from the Customer accounts will be adjusted from 11% to 12%.

The arrangement for implementation of 12% VAT for Mutual Fund transactions is as follows:

- For transaction through Branch:

Transaction Type

Transaction Date

Transaction Fee Debit Date

VAT

Subscription

30 December 2024

30 December 2024

11%

Switching

30 December 2024

31 December 2024

11%

Redemption

30 December 2024

31 December 2024

11%

- For transaction through digibank by DBS Application:

Transaction Type

Transaction Date

Input Time

Transaction Fee Debit Date

VAT

Subscription

30 December 2024

Before 13.00 WIB

30 Desember 2024

11%

30 December 2024

After 13.00 WIB

2 Januari 2025

12%

Switching

29 December 2024

After 13.00 WIB

31 December 2024

11%

30 December 2024

Before 13.00 WIB

31 December 2024

11%

30 December 2024

After 13.00 WIB

3 Januari 2025

12%

Please note the following things regarding VAT of Mutual Fund transactions through digibank by DBS Application:

- For Redemption transaction there is no transaction fee charged to the Customer’s account, therefore no impact caused by this VAT change.

Payment Services in Bayar & Beli - Orange TV, Paypro, XL Tunai

Dear Valued Customers,

Please be informed that the bill payment services for Orange TV, Paypro, and XL Tunai are no longer accessible via Bayar & Beli feature.

Rest assured, you can still use Bayar & Beli feature for other bill payment transactions.

Always update the digibank by DBS App to the latest version on the App Store and PlayStore to enjoy latest features & services.

Addition Types of Instruction that can be Carried out using Instructions Authorization via Telephone PT Bank DBS Indonesia

Effective October 03, 2024, the following additional of instruction types that can be carried out using Instructions Authorization via Telephone PT Bank DBS Indonesia:

- Request of Withholding Tax Receipt

- Request of Monthly Statement

- Request of Fixed Deposit Advice

- Request of Bond Trade Confirmation

The changes are listed in:

- Terms and Conditions for Opening and Managing Individual Account Instruction Authorization via Telephone, Part D Article 1 Point 1.2 Letter K

"Request of of Withholding Tax receipt, and/or Monthly Statement, and/or Fixed Deposit Advice, and/or Bond Trade Confirmation"

- Instruction Authorization via telephone, Point 1.2 Letter K

"Request of Withholding Tax receipt, and/or Monthly Statement, and/or Fixed Deposit Advice, and/or Bond Trade Confirmation"

Click here to view the Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia.

Temporary Closing Switching of Manulife Syariah Golden Asia

Dear Valued Customer,

Referring to the notification provided by PT Manulife Aset Manajemen Indonesia as the Fund Manager, it is hereby informed the temporary closing schedule switching transactions of Reksa Dana Syariah Manulife Saham Syariah Golden Asia Dolar AS (“MAGOLD”) product during the period 25 September – 2 October 2024 , (the “Period”).

|

Date |

Transaction Type |

NAV Date |

Settlement Date |

|

24 September 2024 |

Subscription |

24 September 2024 |

25 September 2024 |

|

24 September 2024 |

Switching |

24 September 2024 |

25 September 2024 |

|

24 September 2024 |

Redemption |

24 September 2024 |

1 October 2024 |

|

25 September – 2 October 2024 |

Subscription & Redemption |

Transaction proceeds as usual |

|

|

25 September – 2 October 2024 |

Switching |

Transaction temporarily closed |

|

|

3 October 2024 onward |

All transaction |

Transaction proceeds as usual |

|

This temporary closure is due to the closing of stock exchanges in China, where most of the MAGOLD securities portfolio will not be traded from , to celebrate the National Day of the People's Republic of China. Subscription and redemption transactions of Participation Units MAGOLD proceed as usual during the .

This implementation applies for all transaction channels & all Selling Agents.

This notice advertisement has been published in PT Manulife Aset Manajemen Indonesia Website

Thank you.

Medan Diponegoro branch office will be moved to the new branch

Dear Valued Customer,Thank you for your support and trust that you have placed in PT Bank DBS Indonesia (“Bank DBS Indonesia”). We always strive to continuously improve the quality of our services, one of which is by taking strategic steps to ensure maximum business growth opportunities.

We are pleased to inform you that effective 28 October 2024, all transactional activities at Bank DBS Indonesia Medan Diponegoro Sub-branch office, located at West Plaza Building Jl. Diponegoro No.16, will be moved to the new branch location at:

Bank DBS Indonesia Kantor Cabang Pembantu Medan Diponegoro

Jl. Diponegoro No. 14 D-E

Medan - Sumatera Utara

For your convenience during the transition period, the current Bank DBS Indonesia Medan Diponegoro Sub-branch Office will continue to serve your banking needs until 25 October 2024 from 08:30 – 15:30 WIB. On the next working day, we welcome you to experience our banking services at the new location of Bank DBS Indonesia Medan Diponegoro Sub-branch office.

Should you require further assistance, please contact your Corporate or Treasures Relationship Manager or 24-hour DBSI Customer Centre at 1500 380 for Corporate and at 1500 327 for Treasures

Thank you and we look forward to serving you better in the greatly improved office surroundings.

Yours faithfully,

PT Bank DBS Indonesia

Asia’s Safest, Asia’s Best

Best Bank in ASIA Pacific 2018, Global Finance

Safest Bank, 2009-2017, Global Finance

World’s Best Digital Bank 2016, Euromoney

Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia

Amendment of terms and conditions on the document of Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia which will be effective as of 1 July 2024 are as follow:

- Changes regarding definition of Bank on Section A Article 1.

- Changes on the terms and conditions regarding General Conditions Account Opening on Section B Article 1 Point a.

- Changes on the terms and conditions regarding Foreign Exchange Transactions on Section B Article 9.2 Point f.

- Changes on the terms and conditions regarding Foreign Exchange Transactions on Section B Article 9.4 Point b and c.

- Changes on the terms and conditions regarding Customer Center on Section D Article 2 Point b and c.

Click here to view the Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia.

Spending Tracker feature on digibank by DBS Application will be deactivated

Effective on 27 July 2024, Spending Tracker feature will be deactivated from digibank by DBS Application. However, you can still enjoy other digibank by DBS Application features for your banking and wealth activities.

Download the latest digibank by DBS Application to enjoy the latest features and services.The operational activity of PT Bank DBS Indonesia due to the Ascension Day and Mass Leave

Dear Valued Customers,

Please be advised. Due to the Ascension Day and Mass Leave, the operational activity of PT Bank DBS Indonesia (Bank DBS) will be closed on Thursday - Friday (9 -10 May 2024).

The branches will be re-opened on Monday,13 May 2024.

PT Bank DBS Indonesia wishes you a Happy Ascension Day.

Thank you

Some Payment Service in Bayar & Beli Feature will be Deactivated

Please be informed that the bill payment services for First Media, Telkom PSTN/Indihome, PAM, PDAM, and PALYA are no longer accessible. Additionally, starting June 8, 2024 the M-TIX XXI top-up service will also be inaccessible. However, you can still use the Bayar & Beli feature for other necessities. Download the latest digibank by DBS apps to enjoy latest features & services.

Dear Valued Customers,

Please be advised. Due to Eid Al Fitr 2024, the operational activity of PT Bank DBS Indonesia (Bank DBS) will be closed on

Monday, 8th April – Monday,15th April 2024.

The branches will be re-opened on Tuesday, 16th April 2024.

PT Bank DBS Indonesia wishes you a Happy Eid Mubarak.

Thank you

Operational activity of PT Bank DBS Indonesia in General Election Day

Dear Valued Customers,

Please be advised. Due to General Election Day, the operational activity of PT Bank DBS Indonesia (Bank DBS) will be closed on Wednesday,14 February 2024. The branches will be re-opened on Thursday, 15 February 2024.

PT Bank DBS Indonesia wishes you a Happy General Election Day

Change in Transaction Cut-Off Time (COT) at Bank DBS Indonesia Branch Office

Bank DBS Indonesia branches operational hours is from 8.30 AM - 3.30 PM (local time) with cut off time for following transaction:|

Type of Transaction |

Cut-off Time effective on

(local time) |

| Cheque clearing | 10 a.m Note: For DBS BSD Branch, the cut-off time: 9.30 a.m |

|

Fund transfer through Real Time Gross Settlement |

1 p.m |

| Fund transfer through National Clearing System | 12.30 p.m |

| Outward Telegraphic Transfer | 1 p.m |

|

Tax Payment |

1 p.m |

For your convenience, we provide digibank by DBS application for you to conduct transaction anytime and anywhere, and Instruction Authorization via Telephone or Instruction Authorization via Email facility.

For more information, please contact your Relationship Manager or DBSI Customer Centre at 1500 327 or +6221 298 52800 (from overseas).

Announcement of Green Savings Account Interest Rate Adjustment

Effective 1 December 2023, there will be an adjustment to the Green Savings Account interest rates.

Here are the Green Savings Account interest rates that will apply:

|

Balance |

Current Interest Rate (per year) |

New Interest Rates (per year) |

|---|---|---|

|

<IDR250 million |

1.25% |

1.25% |

|

IDR250 million - <IDR500 million |

1.75% |

|

|

IDR500 million - <IDR1 billion |

2.25% |

|

|

>IDR1 billion |

3.25% |

System Maintenance Information

We are constantly upgrading our systems to bring you a more pleasant banking experience. During the mentioned period of scheduled maintenance, some of the services will not be available:

DBS - ASPIRE :

|

Date & Time |

Service Under Maintenance |

|

26 November 2023 |

Access to ASPIRE Website will be unavailable. |

Latest updates on the Bayar & Beli feature in the digibank by DBS application

Fulfill all your essentials with the Bayar & Beli feature on the digibank by DBS Application.

Effective November 21, 2023, the Mandiri e-Money Card Top Up service through the Bayar & Beli feature on the digibank by DBS Application will be deactivated.

Please make sure you always update the digibank by DBS application to the latest version on the AppStore and PlayStore to enjoy the latest features and services.

System Maintenance Information

To upgrade our banking services, the digibank by DBS Application will undergo system maintenance at Saturday, 7 October 2023 at 00:00 – 21:00 WIB and some features will be temporarily unavailable. No need to worry as you can still carry out unaffected banking activities.

Below are the unavailable features:

- digibank registration using Debit/Credit Card

- Debit Card request/replacement

- Data update: handphone number, email, address

- Investment risk profile update

We apologise for the inconveniences. If you need any assistance, please contact your Relationship Manager.

Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia

Amendment in The Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia ("Terms and Conditions") to be effective as of 25 September 2023 are as follow:

-

Changes in the definition regarding Green Savings Account on Section A Article.

-

Addition of terms and conditions regarding Instruction Authorization via Telephone on Section D Article 1.2 Paragraph 1.1 Point (i), (j), (k) as follow:

-

(i) Overbooking to the insurance company's account at the Bank, for insurance policy payment in the same name as the account holder.

-

(j) Request of Gift Redemption.

-

(k) Request of Withholding Tax receipt.

-

Click here to view the Terms and Conditions.

If you have objection regarding the changes on the terms and condition regarding Instruction Authorization via Telephone, you can request to revoke the Instruction Authorization via Telephone facility at the nearest Bank's Office Branch.

For more information, please contact your Relationship Manager or DBSI Customer Centre at 1500 327 or +6221 298 52800 (from overseas).

Temporary closing schedule switching transactions "MAGOLD"

Dear Valued Customer,

Referring to the notification provided by PT Manulife Aset Manajemen Indonesia as the Fund Manager, it is hereby informed the temporary closing schedule switching transactions of Reksa Dana Syariah Manulife Saham Syariah Golden Asia Dolar AS (“MAGOLD”) product during the period September 27, 2023 to October 6, 2023 (the “Period”).

|

Date |

Transaction Type |

NAV Date |

Settlement Date |

|

26-Sep-23 |

Subscription |

26-Sep-23 |

27-Sep-23 |

|

26-Sep-23 |

Switching |

26-Sep-23 |

27-Sep-23 |

|

26-Sep-23 |

Redemption |

26-Sep-23 |

4-Oct-23 |

|

27 Sep-6 Oct 23 |

Subscription & Redemption |

Transaction proceed as usual |

|

|

27 Sep-6 Oct 23 |

Switching |

Temporary Closed |

|

|

9-Oct-23 |

All transaction |

Transaction proceed as usual |

|

This temporary closure is due to the closing of stock exchanges in China, where most of the MAGOLD securities portfolio will not be traded from September 29 until October 6, 2023 to celebrate the National Day of the People's Republic of China. Subscription and redemption transactions of Participation Units MAGOLD proceed as usual during the period.

This applicable for all transaction channels & all Selling Agents.

Herewith we attached a notice advertisement that has been published by PT Manulife Aset Manajemen Indonesia through Investor Daily as a reference.

Thank you.

Comprehensive & seamless financial access on digibank Application

Effective on August, 12 2023, Internet banking service through desktop/web browsers has been deactivated.

Let's use digibank by DBS Application for an ease investing on capturing the market momentum, preparing protection needs and all your banking transactions, anytime anywhere so you can be confidently achieving your financial goals.

Download or update the digibank by DBS Application on the App Store and Play Store to continue your transactions and investments here

Operational Activity of PT Bank DBS Indonesia During Eid Adha

Please be advised. Due to Eid Adha, the operational activity of PT Bank DBS Indonesia (Bank DBS) will be closed on Wednesday - Friday (28th - 30th June 2023).

The branches will be re-opened on Monday, 3rd July 2023.

Announcement for Pancasila and Vesak Day 2023

Dear Valued Customers,

Please be advised. Due to Pancasila Day and Vesak Day, the operational activity of PT Bank DBS Indonesia (Bank DBS) will be closed on Thursday - Friday (1st - 2nd June 2023).

The branches will be re-opened on Monday, 5th June 2023.

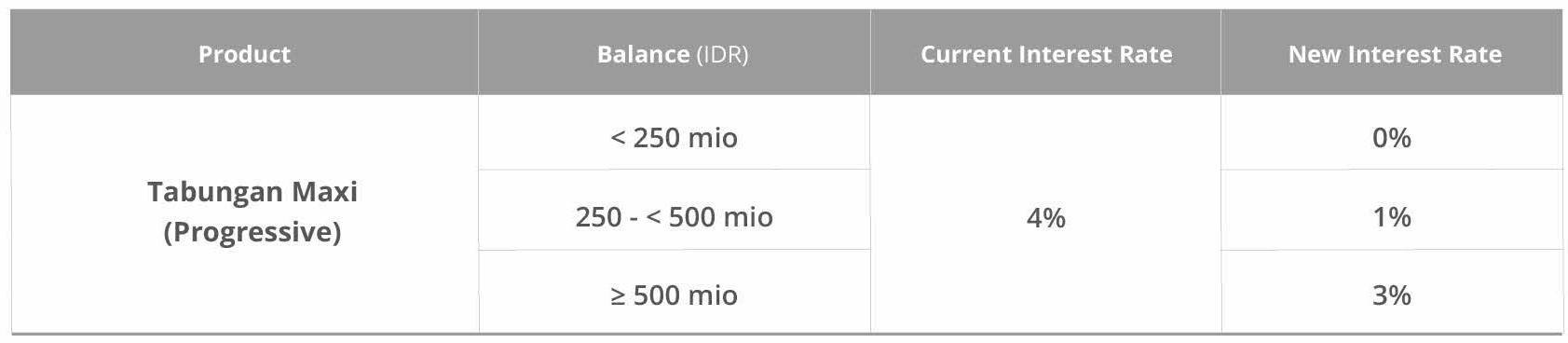

PT Bank DBS Indonesia wishes you a Happy Vesak Day.Announcement for Savings Account Interest Rates Adjustment

We hereby inform you that effective on 10 May 2023 there will be some adjustments on the interest rates for Tabungan Maxi Account (IDR).

The following Tabungan Maxi Account interest rates will apply:

| Product | Balance | Current Interest Rate | New Interest Rate |

| Tabungan Maxi | <250 million | 0% | 3% p.a |

| 250 - <500 million | 1% | ||

| >=500 million | 3% |

Operational Activity of PT Bank DBS Indonesia During Eid Mubarak

Dear Valued Customers,Please be advised. Due to Eid Al Fitr 2023, the operational activity of PT Bank DBS Indonesia (Bank DBS) will be closed on Wednesday – Tuesday (19th -25th April 2023). The branches will be re-opened on Wednesday, 26th April 2023.

PT Bank DBS Indonesia wishes you a Happy Eid Mubarak.

New Menu and Function in CCTR IVR

In order to improve the quality of DBSI Treasures Hotline services, starting 13 January 2023, there is a change in steps in contacting DBSI Treasures Hotline.

Customer may contact DBSI Treasures Hotline at 1500327 or +622129852800 (outside Indonesia). After language selection, kindly select menu:

-

For Treasures and TPC, press 1

If customer presses option 1 then customer will be required to enter the information on the number of savings account/eKTP/Customer will then be connected to the DBSI Treasures Hotline Customer Service Officer.

Dormant Fee Notification

Dear Valued Customer, Starting 15 November 2022, the Customers of DBS Treasures will be charged a maximum fee of IDR50,000 per month if all Current Accounts or Savings Accounts are dormant.

A dormant account is a Current or Savings Account which status changes from active to dormant due to the lack of debit/credit transactions conducted by the Customer for 12 (twelve) consecutive months. All debit transactions cannot be performed, while some credit transactions are limited to protect dormant accounts. The Customer can request for activation to continue performing transactions using the Account.

How to Activate Dormant Account

Activate your Account through one of the three easy ways below:

-

digibank by DBS Application

Limited to partial activation and only Savings Accounts are shown on the app. -

Branch Office

Fill the activation form or perform any transaction. -

Email Instruction

The Customers with Email Instruction facility can send an instruction via email to activate their Account. Limited to partial activation.

Other Announcements

RDS Manulife Saham Syariah Golden Asia Dolar AS

Referring to the notification provided by PT Manulife Aset Manajemen Indonesia as the Fund Manager, it is hereby informed the temporary closing schedule transactions of Reksa Dana Syariah Manulife Saham Syariah Golden Asia Dolar AS ("MAGOLD") product is as follows:

|

Date |

Transaction Type |

NAV Date |

Settlement Date |

|

28 Sep 2022 |

Purchase |

28 Sep 2022 |

28 Sep 2022 |

|

28 Sep 2022 |

Switching |

28 Sep 2022 |

28 Sep 2022 |

|

28 Sep 2022 |

Redemption |

28 Sep 2022 |

14 Oktober 2022 |

|

29 Sep - 9 Oct 2022 |

All Transaction type |

Temporary Closed |

|

|

10 Oct 2022 |

All Transaction type |

Transaction proceeds as usual |

|

This temporary closure is due to the closing of stock exchanges in China, where most of the MAGOLD securities portfolio will not be traded from October 1 until October 9, 2022 to celebrate the National Day of the People's Republic of China thus that MAGOLD portfolios cannot accept Redemption, Switching, nor Purchase (subscription) during the period.

This applicable for transaction channel & all Selling Agents.

Herewith we attached a notice advertisement that has been published by PT Manulife Aset Manajemen Indonesia as a reference.

Announcement for Savings Account Interest Rates Adjustment

We hereby inform you that effective on 1 February 2023 there will be some adjustments on the interest rates for Regular Savings Account (IDR, AUD, SGD), Green Savings Account and Rekening Valas. Increase your balance to gain the maximum interest.

The following Savings Account interest rates will apply:

|

Product |

Currency |

Balance |

New Interest Rates |

|

Regular Savings Account |

IDR |

0 - < 50 million |

0.00% |

|

50 - < 250 million |

0.10% |

||

|

250 - < 500 million |

0.25% |

||

|

500 - < 1billion |

0.50% |

||

|

1 - < 5 billion |

0.75% |

||

|

5 - < 10 billion |

0.75% |

||

|

>= 10 billion |

1.00% |

||

|

AUD |

0-<1,000 |

0.00% |

|

|

≥ 1,000 |

0.10% |

||

|

SGD |

0-<1,000 |

0.00% |

|

|

≥ 1,000 |

0.10% |

||

|

Green Savings Account |

IDR |

All |

1.25% |

|

Rekening Valas |

AUD |

0-<1,000 |

0.10% |

|

≥ 1,000 |

0.25% |

||

|

SGD |

0-<1,000 |

0.10% |

|

|

≥ 1,000 |

0.25% |

Fund Transfer through BI-FAST in digibank by DBS Application

Effective on August 2022, there is new method of local interbank fund transfer in digibank Application by DBS which is through BI-FAST.

The benefits of using BI-FAST:

-

Real-time online Fund Transfer.

-

Free of charge.

-

Transaction limit up to IDR100.000.000 (one hundred million Rupiah) per transaction and IDR250.000.000 (two hundred fifty million Rupiah) per day.

Steps to transfer using BI-FAST in digibank by DBS Application:

-

Login to digibank by DBS Application.

-

Select "Transfer Rupiah" at home page.

-

Input Rupiah transfer recipient detail. BI-FAST transfer method will be automatically linked if the destination bank is registered as BI-FAST participant.

- Click "Lanjut", then enter password

-

Transfer transaction confirmation

DBS Indonesia Branches Operational Hours Resume Normally

We would like to inform you that effective on 2 June 2022, Bank DBS Indonesia branches operational hours will resume normally from 8.30 AM - 3.30 PM (local time) with cut off time for following transaction:

|

Type of transaction |

Cut-off time (WIB) |

|

Cheque clearing |

10 a.m

Note: For DBS BSD Branch, the cut-off time: 9.30 a.m |

|

Fund transfer through National Clearing System |

12 p.m |

|

Fund transfer through Real Time Gross System |

12 p.m |

|

Outward Telegraphic Transfer |

12 p.m |

|

Tax Payment |

1 p.m |

For your convenience, we provide digibank by DBS application for you to conduct transaction anytime and anywhere, and Instruction Authorization via Telephone or Instruction Authorization via Email facility.

For more information, please contact Your Relationship Manager or DBSI Customer Centre at 1500 327 or +6221 298 52800 (from overseas).

DBS Indonesia Branches Operational Hours Resume Normally

We would like to inform you that effective on 2 June 2022, Bank DBS Indonesia branches operational hours will resume normally from 8.30 AM - 3.30 PM (local time) with cut off time for following transaction:

|

Type of transaction |

Cut-off time (local time) |

|

Cheque clearing |

10 a.m

Note: For DBS BSD Branch, the cut-off time: 9.30 a.m |

|

Fund transfer through National Clearing System |

12 p.m |

|

Fund transfer through Real Time Gross System |

12 p.m |

|

Outward Telegraphic Transfer |

12 p.m |

|

Tax Payment |

1 p.m |

For your convenience, we provide digibank by DBS application for you to conduct transaction anytime and anywhere, and Instruction Authorization via Telephone or Instruction Authorization via Email facility.

For more information, please contact Your Relationship Manager or DBSI Customer Centre at 1500 327 or +6221 298 52800 (from overseas).

Information on the Implementation of Stamp Duty on Mutual Fund Transaction Confirmation Documents - Effective 1 August 2022

Dear Valued Customer,

Refers to the following regulation:

-

Law No. 10 of 2020 concerning Stamp Duty ("Stamp Duty Law");

-

Government Regulation ("PP") No. 3 of 2022 concerning the Provision of Exemption and Imposition of Stamp Duty Facilities;

-

Regulation of the Minister of Finance ("PMK") Numbers 133 and 134 of 2021 concerning Stamp Duty; and

-

Letter from the Directorate General of Taxes Number S-143/PBM/PJ/2022 dated February 22, 2022 regarding Letter of Determination of KSEI as Stamp Duty Collector since March 1, 2022

In which it is stated that there is a stamp duty fee on the confirmation document of the Mutual Fund transaction. The stamp duty fee applies to the total accumulated value of Mutual Fund transactions above IDR10 million per day at all Mutual Fund Selling Agents (APERD).

The Customer as the Participation Unit Holder ("PUP")/Investor to bear the stamp duty fee for this Mutual Fund transaction confirmation document. The application of stamp duty fees to the Customer will be implemented for Mutual Fund transactions starting on August 1, 2022 and the debiting of stamp duty fees will be carried out starting September 2022.

The calculation of the stamp duty fee is calculated proportionally by KSEI as the collector appointed by the Directorate General of Taxes based on the number of consolidated transactions of all APERDs carried out by the Mutual Fund PUP on a daily basis, a maximum of IDR10,000 per day.

The types of transactions subject to stamp duty include Subscription, Redemption, Switch-in, Switch-out, Reinvestment, Liquidation, Unit Adjustment and/or other types of transactions as determined by the Financial Services Authority (OJK).

Simulation of the calculation of stamp duty charges:

|

Tanggal |

Tipe |

SID |

Nama |

Kode |

Kode |

Nominal Transaksi (Rp) |

Biaya Bea |

|

20220807 |

Subscription |

IDD1 |

Andi |

RD EQ |

Bank ABC |

20,000,000 |

2,500 |

|

20220807 |

Redemption |

IDD1 |

Andi |

RD MM |

Fintech ABC |

30,000,000 |

2,500 |

|

20220807 |

Subscription |

IDD1 |

Andi |

RD MM |

Bank 123 |

30,000,000 |

2,500 |

|

20220807 |

Redemption |

IDD1 |

Andi |

RD MM |

DBS Indonesia |

90,000,000 |

2,500 |

|

20220807 |

Subscription |

IDD2 |

Dwi |

RD FI |

DBS Indonesia |

50,000,000 |

10,000 |

|

20220807 |

Subscription |

IDD3 |

Joko |

RD EQ |

Fintech ZYZ |

5,000,000 |

3,333 |

|

20220807 |

Switch-In |

IDD3 |

Joko |

RD FI |

DBS Indonesia |

6,000,000 |

3,333 |

|

20220807 |

Switch-Out |

IDD3 |

Joko |

RD MM |

DBS Indonesia |

6,000,000 |

3,333 |

Based on the simulation example above, the stamp duty fees that will be debited by Bank DBS Indonesia in the following month (September 2022):

-

Customer Andi: IDR2,500,-

-

Customer Dwi: IDR10,000,-

-

Customer Joko: IDR6,666,-

Fees will be debited from the Customer’s savings account at Bank DBS Indonesia which is linked to the Investment Account with the debit description "Biaya Meterai Konfirmasi Transaksi Reksa Dana MMM-YY"

Information on the Implementation of Stamp Duty on Bond Transaction Confirmation Documents - Effective 1 August 2022

Dear Valued Customer,

Refers to the following regulation:

Government Regulation ("PP") No. 3 of 2022 concerning the Provision of Exemption and Imposition of Stamp Duty Facilities; Regulation of the Minister of Finance ("PMK") Numbers 133 and 134 of 2021 concerning Stamp Duty;In which it is stated that there is a stamp duty fee on the confirmation document of the Bond transaction of the value Bond transactions above IDR 10 million.

The Customer as the Investor to bear the stamp duty fee for this Bond transaction confirmation document. The application of stamp duty fees to the Customer will be implemented for Bond transactions starting on August 1, 2022 and the debiting of stamp duty fees will be carried out starting September 2022.

The types of transactions subject to stamp duty include Subscription and Redemption and/or other types of transactions at the Bond trading confirmation.

Simulation of the calculation of stamp duty charges:

|

Tanggal |

Tipe |

SID |

Nama |

Kode |

Nominal Transaksi (Rp) |

Biaya Bea |

|

7 Agustus’22 |

Beli |

IDD1 |

Andi |

FR089 |

7,000,000 |

10,000 |

|

7 Agustus’22 |

Jual |

IDD1 |

Andi |

FR065 |

5,000,000 |

|

|

7 Agustus’22 |

Beli |

IDD2 |

Roy |

FR089 |

7,000,000 |

- |

|

20 Agustus’22 |

Beli |

IDD3 |

Alex |

SR017 |

20,000,000 |

- |

Based on the simulation example above, the stamp duty fees that will be debited by Bank DBS Indonesia in the following month (September 2022):

-

Customer ino. Andi: Rp10.000,-

Total amount Bond transaction in secondary market > Rp 10juta, that Customer will be charged stamp duty by Bank DBS Indonesia = Rp10.000,- -

Customer ino. Roy:

Total amount Bond transaction in secondary market < Rp 10juta, that Customer shall not be charged stamp duty cost. -

Customer ino. Alex:

The Customer shall not be charged stamp duty because the Customer buys SR017 in IPO (not in secondary market).

Fees will be debited from the Customer’s savings account at Bank DBS Indonesia which is linked to the Investment Account with the debit description "Biaya Meterai Konfirmasi Transaksi Obligasi Pasar Sekunder MMM-YY"

Note:

Customer transaction detail cab be seen at Digibank applications.

Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia

New and Amendment of Terms and Conditions on the document of Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia which will be effective as of 5-July-2022 are as follow:

-

Add definition regarding with Green Savings Account on Section A Article 1.

-

Add definition regarding with Multi Currency Account on Section A Article 1.

-

Add definition regarding Structured Product on Section A Article 1.

-

Add terms and conditions regarding Green Savings Account on Section C Article 4.

-

Add terms and conditions regarding Multi Currency Account on Section C Article 3.

-

Add terms and conditions regarding Products of Other Parties on Section C Article 7a.

-

Add terms and conditions regarding Structured Product on Section C Article 8.

-

Changes on the terms and conditions regarding Instruction Authorization via Telephone on Section D Article 1.2.

-

Changes on the terms and conditions regarding Instruction Authorization via Email on Section D Article 1.3.

-

Add terms and conditions regarding General Terms Regarding ATM and DBS Debit Card on Section D Article 5a.

Click here to view the Terms and Conditions for Opening and Managing Individual Accounts of PT Bank DBS Indonesia.

Notification of Bank DBS Indonesia Branches Operational and Monthly Statement Delivery

We would like to inform You that due to Eid Mubarak 1443 H public holiday and mass leave in Indonesia, Bank DBS Indonesia branches will be closed from 29 April - 6 May 2022 and will be operated on 9 May 2022 from 9 a.m. to 2.30 p.m. We would also like to inform You that the process of delivering Your monthly combined statement April 2022 will experience delays.

E-Statement April 2022 will be sent to the Customer’s registered email address on the 3rd (third) week of May 2022 (applicable for the Customer who has registered e-Statement facility). The Customer could access e-Statement fast, easy and safe through digibank by DBS Application.

Please ensure that Your registered email address and handphone number in Bank DBS Indonesia is updated to perform the registration of digibank by DBS Application. For email address and handphone number registration and/or updates, please contact Your Relationship Manager.

For hardcopy Monthly Combined Statement will takes delivery times as follow:

-

Jabodetabek: 5 working days

-

Non - Jabodetabek: 8 working days

Should you have further question, please contact DBSI Customer Centre at 1500-327 or +6221-298-52800 (from overseas).

Changes in VAT for Mutual Fund Transaction and Safe Deposit Box Rental Fees - Effective April 1st 2022

Dear Valued Customer,

Referring to Law No. 7 of 2021 concerning Harmonization of Tax Regulations, it is stated in Chapter IV- Value Added Tax - article 7 paragraph (1) Value Added Tax Rates are:

-

11% (eleven percent) which will take effect on 1 April 2022;

-

12% (twelve percent) which will take effect no later than 1 January 2025

Based on this regulation, effective 1 April 2022, Mutual Fund transaction fees debited from customer accounts and Safe Deposit Box Rental Fees will be subject to 11% VAT.

The arrangement for implementation of 11% Value Added Tax ("VAT") is as follows:

-

For transaction through Branch:

Transaction Type

Transaction Date

Transaction Fee Debit Date

VAT

Subscription

31-Mar-22

31-Mar-22

10%

Switching

31-Mar-22

01-Apr-22

11%

Redemption

31-Mar-22

01-Apr-22

11%

-

For transaction through digibank by DBS Application:

Transaction Type

Transaction Date

Input Time

Transaction Fee Debit Date

VAT

Subscription

31-Mar-22

Before 13.00 WIB

31-Mar-22

10%

31-Mar-22

After 13.00 WIB

01-Apr-22

11%

Switching

30-Mar-22

After 13.00 WIB

01-Apr-22

11%

31-Mar-22

Before 13.00 WIB

01-Apr-22

11%

31-Mar-22

After 13.00 WIB

01-Apr-22

11%

Please note the following things regarding VAT of Mutual Fund transactions through digibank by DBS Application:

-

For Switching transactions inputted on 30 March 2022 after 13.00 WIB and inputted on 31 March 2022 before 13.00 WIB, the "Verification" page will still display the VAT percentage of 10%. However, when Switching transaction fee debited on April 1st the VAT applied will be 11%.

-

For Redemption transaction there is no transaction fee charged to customer’s account, therefore no impact caused by this VAT change.

Safe Deposit Box ("SDB") Rental Fees

DBS Indonesia Bank will adjust debited VAT from 10% to 11% for Safe Deposit Box rental fees with following arrangement for implementation of 11% Value Added Tax:

|

Size |

Rental Fee (per year) |

Rental payment period (VAT imposition) |

|||||

|

March 2022 |

01 April 2022 onwards |

||||||

|

(%) |

IDR |

Total |

(%) |

IDR |

Total |

||

|

SMALL |

IDR500,000 |

10% |

50.000 |

550.000 |

11% |

55.000 |

555.000 |

|

MEDIUM |

IDR750,000 |

10% |

75.000 |

825.000 |

11% |

82.500 |

832.500 |

|

LARGE |

IDR1,000,000 |

10% |

100.000 |

1.100.000 |

11% |

110.000 |

1.110.000 |

|

GRANDE |

IDR1,500,000 |

10% |

150.000 |

1.650.000 |

11% |

165.000 |

1.665.000 |

In relation to SDB rental extension payment period that are due before month April 2022 but the payment is performed on and after month April 2022, then will follow the new VAT provision which is 11%.

SDB Rental Fee Criteria

|

Size |

Rental Fee (per year) |

Total Relationship Balance |

||

|

IDR500 mio - < IDR 1 bio |

IDR 1 bio - < IDR 5 bio |

> IDR 5 bio |

||

|

SMALL |

IDR500,000 |

25% discount, 1 Unit |

Free of charge, 1 Unit |

Free of charge 1 Unit |

|

MEDIUM |

IDR750,000 |

|||

|

LARGE |

IDR1,000,000 |

|||

|

GRANDE |

IDR1,500,000 |

No discount, 1 Unit |

25% discount, 1 Unit |

|

-

Rental Fees are subject to 11% VAT.

-

Key guarantee fee of IDR900,000 borne by customer upfront when opening a Safe Deposit Box.

-

Request for Safe Deposit Box rental based on availability in particular branches.

-

Safe Deposit Box only apply for Treasures customer whose Total Relationship Balance ≥ IDR 500 mio and maximum 1 Safe Deposit Box per customer.

Temporary Closing Schedule Transactions of Reksa Dana Syariah Manulife Saham Syariah Golden Asia Dolar Asia AS ("MAGOLD")

Dear Valued Customer,

Referring to the notification provided by PT Manulife Aset Manajemen Indonesia as the Fund Manager, it is hereby informed the temporary closing schedule transactions of Reksa Dana Syariah Manulife Saham Syariah Golden Asia Dolar AS ("MAGOLD") product.

|

Date |

Transaction Type |

Transaction NAV Date |

Settlement Date |

|

25-Jan-22 |

Purchase |

25-Jan-22 |

26-Jan-22 |

|

25-Jan-22 |

Switching |

25-Jan-22 |

26-Jan-22 |

|

25-Jan-22 |

Resale |

25-Jan-22 |

02-Feb-22 |

|

26 Jan – 4 Feb 2022 |

All transaction |

Unable to transact |

|

|

07-Feb-22 |

All transaction |

Transactions are processed normally |

|

This temporary closure is due to the closing of stock exchanges in China, where most of the MAGOLD securities portfolio will not be traded from January 26 until February 4, 2022 to celebrate the 2022 Chinese New Year. During that period MAGOLD portfolios cannot accept Redemption, Switching, nor Purchase (subscription).

Transaction can be performed on 7 February 2022.

This applicable for transaction channel & all Selling agents.

Herewith we attached a notice advertisement that has been published by PT Manulife Aset Manajemen Indonesia as a reference.

Thank you.

Tax Witholding Slip and Bank Reference Letter through DBSI Customer Centre

Dear valued Customer,

Thank you for choosing PT Bank DBS Indonesia ("Bank") as your trusted wealth partner, so you can always live with an edge to optimise your wealth confidently.

We would like to inform you that effective on 18 February 2022, DBS Treasures Customer can request Tax Witholding Slip and Bank Reference Letter through DBSI Customer Centre at 1500327 or +6221 298 52800 (from outside Indonesia).

Tax Witholding Slip request covers saving account, current account, fixed deposit and bonds.

Tax Witholding Slip and Bank Reference Letter will be sent through email to the Customer’s registered email address. For hardcopy Bank Reference Letter request, DBS Treasures Customer with total relationship balance below IDR1,000,000,000.- (one billion Rupiah) will be charged with fee of IDR50,000.- (fifty thousand Rupiah).

For more information, please contact DBSI Customer Centre at 1500327 or +6221 298 52800 (from outside Indonesia).Terms and Conditions Update for Cheque/Bilyet Giro Book Request and Activation

Hereby, we would like to inform regarding the Terms and Conditions Update for Cheque/Bilyet Giro Book Request and Activation with detail as follow:

-

The Customer agrees that charges related to the order of Cheque and/or Bilyet Giro book will be debited from the Customer's Account.

-

Referring to Bank Indonesia Circular Letter No. 9/13/DASP dated 19 June 2007 as lastly amended with Bank Indonesia Circular Letter No. 18/39/DPSP dated 28 December 2016 regarding National Blacklist Towing Cheque and/or Giro Blank and its attachment:

-

The Customer agrees that the Customer will be penalized by freezing the usage rights of Cheque and/or Bilyet Giro, and/or the identity shall be listed in National Blacklist (DHN) in the event of withdrawal of a blank Cheque and/or Bilyet Giro which fulfill the criteria of DHN as per prevailing regulation or due to the identity has been listed in DHN by another bank.

-

The Customer agrees that the Customer is obliged to report the fulfillment of settlement obligation regarding the blank Cheque and/or Bilyet Giro withdrawal in which the fulfillment must be done within 7 (seven) Business Days after the rejection date.

-

-

The Customer is required to return the Activation Sheet contained in the Cheque and/or Bilyet Giro book to the Bank before the said Cheque and/or Bilyet Giro is used.

-

In the condition where the Cheque and/or Bilyet Giro has been used/drawn/cleared without prior activation, the Bank’s Staff will perform callback to the Customer to activate the Cheque/Bilyet Giro book. If the Customer is unable to be contacted, the Bank has the right to activate the Cheque and/or Bilyet Giro book.

-

After the Cheque and/or Bilyet Giro book is received by the Customer directly or through of Power of Attorney to the appointed party, the Customer is fully responsible for the use of the said Cheque/Bilyet Giro book.

Effective December 15th, 2021, orders for Cheque and/or Bilyet Giro book must use the Cheque/Giro book Request Form which You can get here. The order sheet in the Cheque and/or Bilyet Giro book is no longer valid.

For more information, please contact your Relationship Manager or DBSI Customer Centre at 1500 327 or +6221 298 52800 (from overseas).

Change of DBS Debit card cash withdrawal limit

In accordance with Undang-Undang No. 23 of 1999 and Bank Indonesia Regulation No. 22/7/PBI/2020 and Bank Indonesia Circular No. 17/51/DKSP, the temporary adjustment of the maximum nominal value of funds for cash withdrawals through ATM machines is as follows:

-

Increase the maximum nominal value of funds for withdrawals through ATM machines from IDR15,000,000 (fifteen million Rupiah) to IDR20,000,000 (twenty million Rupiah) per account within 1 (one) day for ATMs with using chip technology.

-

Adjustment of the maximum nominal value of funds for cash withdrawals through ATM machines is valid from temporarily 12 July 2021 to 30 September 2021.

Transaction Type

Debit Card DBS GPN

Debit Card DBS Visa Platinum

Debit Card DBS Treasures Visa Platinum

Debit Card Treasures Private Client VISA Platinum

Per Day

Per Day

Per Day

Per Day

Cash Withdrawals at ATMs with chip technology

Maximum per account*

IDR20,000,000

IDR20,000,000

IDR20,000,000

IDR20,000,000

Maximum per card**

IDR20,000,000

IDR25,000,000

IDR50,000,000

IDR100,000,000

* The maximum limit for cash withdrawals and interbank transfers refers to the applicable Bank Indonesia regulations. If one account is connected to more than one DBS Debit Card, the maximum transaction limit will be accumulated.

** Only valid if the Customer has more than one account connected to the DBS Debit Card.

As for cash withdrawals through ATM machines that use magnetic stripe technology still cannot be done to protect Bank DBS Indonesia Customers from data theft (skimming) by irresponsible parties.

Please see below locations of DBS Indonesia ATM:

|

ATM |

Location |

|

ATM DBS Tower |

DBS Bank Tower, Lobby Floor Ciputra World 1 Jl. Prof. Dr. Satrio Kav. 3 - 5 Jakarta 12940 |

|

Tel: +62-21-2988-5000 |

|

|

Fax: +62-21-2988-5498 |

|

|

ATM DBSI Ir. Juanda |

Jl. Ir. H Juanda No.23-24 Kebon Kelapa, Gambir Jakarta Pusat 10120 |

|

10120 |

|

|

Tel: +62-21-30432400 |

|

|

Fax: +62-21-3820865 |

|

|

ATM DBSI Kelapa Gading |

Ruko Kelapa Gading Komplek Inkopal Blok C No. 1 - 3 Jl. Boulevard Barat, Kelapa Gading Jakarta Utara |

|

14240 |

|

|

Tel: +62-021–30482800 |

|

|

Fax: +62-21-2453 5789 |

|

|

ATM DBSI Kemang Raya |

Jl Kemang Raya no 2, Jakarta Selatan |

|

12730 |

|

|

Tel: +62-21-30051750 / 3005179 |

|

|

Fax: +62-21-6231 1301 |

|

|

ATM DBSi Palembang |

Jln. Letkol Iskandar No. 761 unit 3-4 Palembang, Sumatera Selatan 30124 |

|

Tel: +62-711 361899 |

|

|

Fax: +62-711 377855 |

|

|

ATM DBSI Puri |

Komplek Ruko Grand Puri Niaga Blok K6 No. 1C & 1D Kembangan Jakarta Barat, 11610 |

|

11610 |

|

|

Tel: +62-21-5835 3337 |

|

|

Fax: +62-21-5835 3557 |

|

|

Bank DBS Indonesia Kemayoran |

Gedung Citra Tower, Jalan Benyamin Suaeb, Kav A6, Kemayoran Jakarta 10630 |

|

10630 |

|

|

Tel: +62216542499 |

|

|

Fax: +62216542466 |

|

|

DBSI Balikpapan |

Jl Jend. Sudirman No. 347 Balikpapan Kalimantan Timur |

|

76114 |

|

|

Tel: +62-542 441944 |

|

|

Fax: +62-542 441940 |

|

|

DBSI Bandung Djuanda |

Jl. Ir. Juanda No. 7-9 Bandung 40116 |

|

40116 |

|

|

Tel: +62-22-3000-3700 |

|

|

Fax: +62-22-426 1130 |

|

|

DBSI Bandung Jawa |

Jl. Jawa No. 1 Bandung Jawa Barat |

|

40117 |

|

|

Tel: +6222-3002 3500 |

|

|

Fax: +62-22-423 2883 |

|

|

DBSI Bumi Serpong Damai |

Komplek Ruko Bidex, Blok C No. 5-6, Jl. Pahlawan Seribu, Serpong, Tangerang Selatan, Banten |

|

15318 |

|

|

Tel: +62-21-537 5505 |

|

|

Fax: +62-21-537 5436 |

|

|

DBSI Capital Place |

Gedung Capital Place, 16th Floor Jl. Jend. Gatot Subroto Kav. 18 Jakarta 12710 |

|

Jakarta 12710 |

|

|

Tel: +62-21-3118-3688 |

|

|

Fax: +62-21-3118-3699 |

|

|

DBSI Denpasar |

Jl Teuku Umar No 10 Blok A1-A3 Denpasar |

|

80114 |

|

|

Tel: +62-361-3010400 |

|

|

Fax: +62-361-224 221 |

|

|

DBSI Makassar |

Jl. Haji Bau No. 36 |

|

90125 |

|

|

Tel: +62-411-879 279 |

|

|

Fax: +62-411-879 280 |

|

|

DBSI Manado |

Kawasan Ruko Megamas Blok 1 C1 No 1 Jl. Piere Tendean Kota Manado 95111 |

|

95111 |

|

|

Tel: +62-431-6002700 |

|

|

Fax: +62-431-859 880 |

|

|

DBSI Mangga Dua |

Mangga Dua Square, Blok H Nomor 8 & 9, Jl. Gunung Sahari Raya , Jakarta Utara - 14430 |

|

14430 |

|

|

Tel: +62-21-30051750/30051793 |

|

|

Fax: +62-21-6231 1301 |

|

|

DBSI Medan Diponegoro |

West Plaza Building, Ground Floor, Jl. Diponegoro No. 16 Medan, Sumatera Utara 20112 |

|

20112 |

|

|

Tel: +62-061-452 7011 |

|

|

Fax: +62-61-452 7611 |

|

|

DBSI Medan Imam Bonjol |

Jl. Imam Bonjol No. 26 A Medan, Sumatera Utara 20152 |

|

Tel: +62-61-30014900 |

|

|

Fax: +62-61-414 5488 |

|

|

DBSI Pantai Indah Kapuk |

Ruko Metro Broadway Blok 8CA, Jalan Pantai Indah Utara 2 |

|

14460 |

|

|

Tel: +62-21-3049 5288 |

|

|

Fax: +62-21-3049 5299 |

|

|

DBSI Pekanbaru |

Jl. Jend Sudirman No. 174 D-E, Pekanbaru |

|

28282 |

|

|

Tel: +62-761–9000100 |

|

|

Fax: +62-761-839 188 |

|

|

DBSI Permata Hijau |

Kantor Emerald No. 23 - 24, Grand Itc Permata Hijau, Jl. Letjen Soepono, Arteri Permata Hijau |

|

12210 |

|

|

Tel: +62-21-5366 4471 |

|

|

Fax: +62-21-5366 4470 |

|

|

DBSI Pluit |

DBSI Pluit, Ruko Pluit Village Blok MG No. 40 - 41, Jl Pluit Indah Raya, Pluit ,Jakarta Utara 14450 |

|

14450 |

|

|

Tel: +62-21-30450450 |

|

|

Fax: +62-21-6683769 |

|

|

DBSI Pontianak |

DBSI Pontianak, Jl. Ahmad Yani No.32 A-B Pontianak, Kalimantan Barat 78121 |

|

78121 |

|

|

Tel: +62-561-745 300 |

|

|

Fax: +62-561-745 505 |

|

|

DBSI Samarinda |

Jalan Awang Long No. 22, Samarinda |

|

75121 |

|

|

Tel: +62-541-746 288 |

|

|

Fax: +62-541-746 658 |

|

|

DBSI Semarang |

Jl. Pandanaran 46 Semarang |

|

50134 |

|

|

Tel: +62-24-3300 8200 |

|

|

Fax: +62-24-845 6719, 845 5009 |

|

|

DBSI Solo |

Jl. Slamet Riyadi No.73, B-D, Surakarta |

|

57112 |

|

|

Tel: +62-271 3006600 |

|

|

Fax: +62-271 3006640 |

|

|

DBSI Surabaya Galaxy |

Ruko Mega Galaxy, Jl.Kertajaya Indah Timur 14C No 1 & 2 Surabaya Jawa Timur 60116 |

|

60116 |

|

|

Tel: +62-31-5912778 |

|

|

Fax: +62-31-5912779 |

|

|

DBSI Surabaya Pemuda |

Jl. Pemuda No.54 Embong Kaliasin Genteng Kota SBY Jawa Timur 60271 Indonesia |

|

Tel: +62-31-600 10900 |

|

|

Fax: +62-31-531 0277 |

|

|

DBSI Surabaya Sungkono |

Jl. Mayjen Sungkono 91 Surabaya, Jawa Timur 60189 |

|

60189 |

|

|

Tel: +62-31-6003 9299 |

|

|

Fax: +62-31-6003 9277 |

|

|

DBSI Tomang |

Total Building, Ground Floor, Jl. Letjen S. Parman Kav. 106A, Tomang |

|

11440 |

|

|

Tel: +62-21-2556 6255 |

|

|

Fax: +62-21-2556 6222 |

|

|

Treasures Centre at Pondok Indah |

Jl. Sultan Iskandar Muda Kav V-Ta, Pondok Indah, Jakarta 12310 |

|

Tel: +62-21–30488900 |

|

|

Fax: +62-21-2758-6698 |

Announcement of Termination of US Dollar Bank Draft, Change of Stamp Duty Fees, and Interest Rates Adjustment

Dear valued customers,

Effective on 01 January 2021, there are adjustments of interest rates along with the termination of US Dollar bank draft as follow:

- Termination of US Dollar Bank Draft

The Bank Draft issuance service in US Dollar is no longer available. - Adjustments of Savings Account & Current Account Interest Rates

- Local Currency

- Foreign Currencies

- Local Currency

- Adjustment of Tabungan Maxi Interest Rate with the progressive method

- Changes of stamp duty tariff and terms of use

- Change of stamp duty tariff to IDR 10,000 for documents with a nominal value of more than IDR 5,000,000

- Existing stamp duties can be used until 01 January 2022 with a minimum total stamp tariff of IDR 9,000

For more information, please contact your Relationship Manager.

Announcement Cheque/Current Stamp Duty

In accordance with Law No. 10 of 2020 concerning Stamp Duty, please see below adjustment to the Stamp Duty rate:

-

As of January 1, 2021, the applicable Stamp Duty is one tariff, which is Rp. 10.000,-

-

The remaining Rp3.000,- and Rp6.000,- stamps can still be used until December 31, 2021, provided that the affixed stamp duty on the Document is at least Rp9.000,-

-

Monthly Account Statement/ Movement of Account Balance will not be subject to Stamp Duty.

In accordance with the Regulation of the Director General of Taxes No. PER-01/PJ/2021 concerning Procedures for Settlement of the Difference of Less Stamp Duty Payable on Documents in the form of Checks and Bilyet Giro and Circular Letter of the Director General of Taxes No. SE-01/PJ/2021 concerning Instructions for Applying Stamp Proof of Payment of the Difference of Less Stamp Duty as of January 8, 2021, for Checks and Bilyet Giro, the following conditions apply:

-

Old Checkbooks and Bilyet Giro with Stamp Duty of Rp3.000,- per sheet can still be used for transactions and the fee rate per book is fixed at Rp125.000,-

-

Checks and Bilyet Giro that still carry a Stamp Duty of Rp3.000,- per sheet can still be used whether withdrawn from the Branch or clearing from other banks:

-

Customers not to add stamp duty on the Cheques and Bilyet Giro sheets to settle the shortage of Stamp Duty on the Checks and Bilyet Giro.

-

For Checks and Bilyet Giro that are already in circulation, the shortage of Stamp Duty of Rp7.000,- per sheet will be debited from the Customer's account at the time of withdrawal*, then deposited by the Bank to the State Treasury.

-

The Customer is required to ensure that the funds available in the Account are sufficient for the payment of the Check and Bilyet Giro process and the settlement of Stamp Duty.

-

-

To order new Check and Bilyet Giro book with Stamp Duty of Rp10.000,- per sheet, a fee per book of Rp300.000,- will be charged.

The Bank will debit the accumulated shortage of Stamp Duty of Rp7.000,- per sheet on the Checks and Bilyet Giro that have been cleared from Customer's account for the period January - June 2021 starting 1 July 2021. Going forward, Bank will debit shortage of Stamp Duty per withdrawal transaction.

Announcement for Interest CASA adjustment 01 July 2020

Here with we inform You that effective from 1 July 2020, the interest rate for Your AUD and USD Saving Accounts have changed. Increase Your balance to get the maximum interest. Please see the following information for the interest rate of AUD and USD Saving Accounts

Announcements for Changes to the Savings and Current Account Interest Calculation Method and Changes in Foreign Currency Savings Interest

Dear valued customer,

Hereby we inform that effective March 1, 2020, the interest calculation method for your savings and current accounts, as well as the interest rates for foreign currency savings and current accounts will change

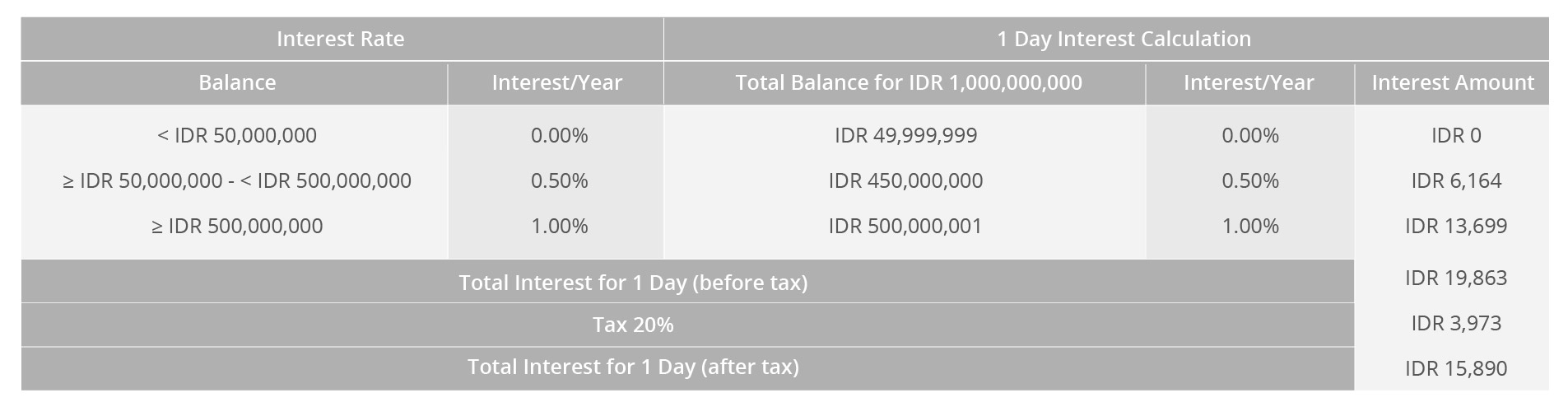

Continue to increase your balance to get the maximum interest rate. Here we submit an example of the calculation of savings and current accounts interest rates, as well as interest rates on savings and current accounts in foreign currencies that will apply:

Example of new interest calculation:

End of day balance for Regular Savings Account customer Rp 1,000,000,000, then the calculation of interest on Regular Savings Account for 1 day are as follows:

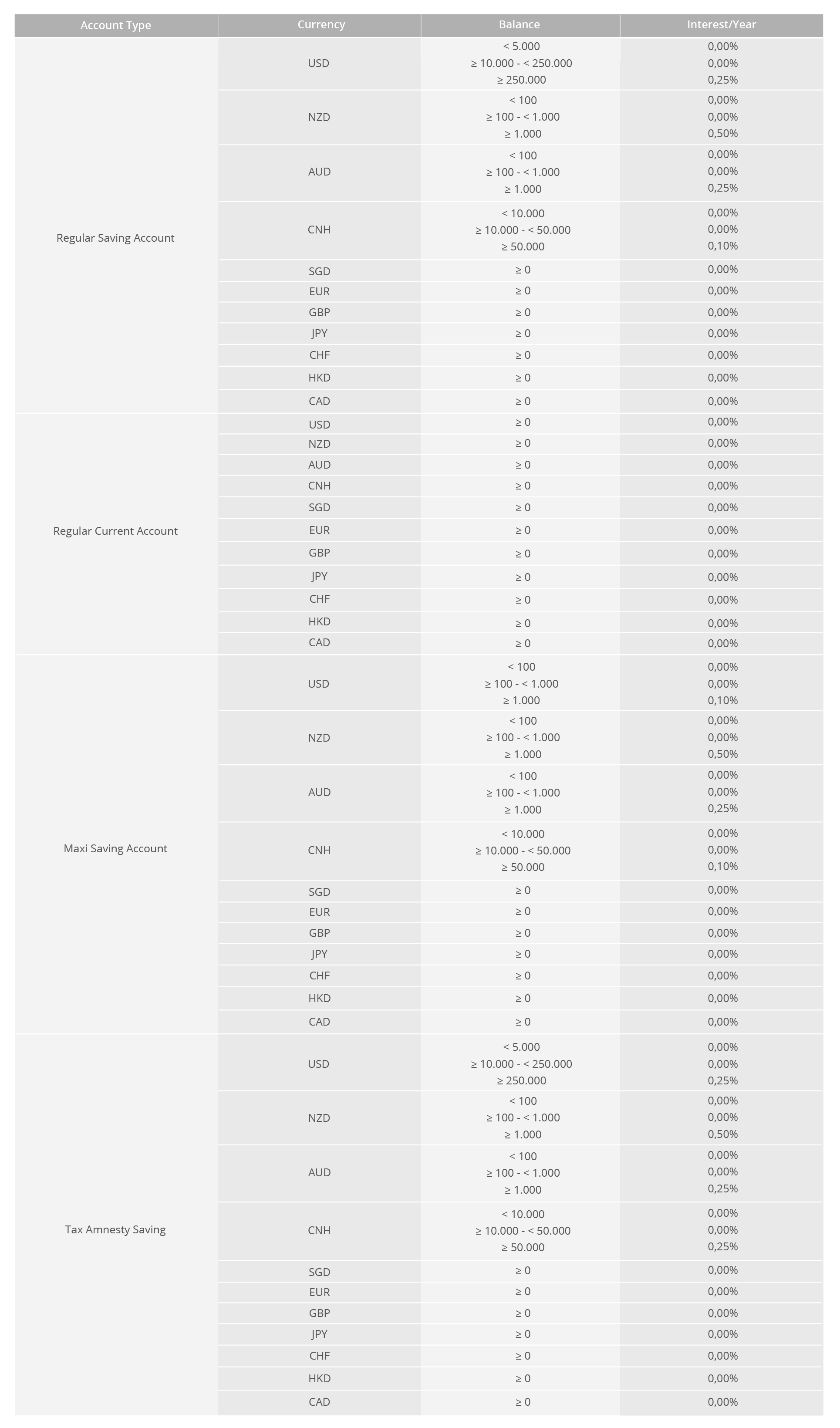

Foreign currencies Savings and Current accounts interest rate that will apply

Thank you.

PT Bank DBS Indonesia

Quick Links

Need Help?