At a Glance

Simple underwriting process

Up to IDR5 billion.

Life protection up to 99 years old

Death Benefit and Maturity Benefit.

Additional Protection Benefit

Additional Accidental Death Benefit*.

Potential Upside Benefit

Paid up additional as potential enhancer to the sum insured (non-guaranteed) for inflation protection.

Feature & Benefit

Product Feature:

-

Entry age of the Insured 18 years old to 70 years old.

-

Available in IDR and USD currency.

-

Premium payment period option in single premium and regular premium (2 or 5 years).

-

The basic premium is fixed throughout the premium payment period.

Product Benefit:

-

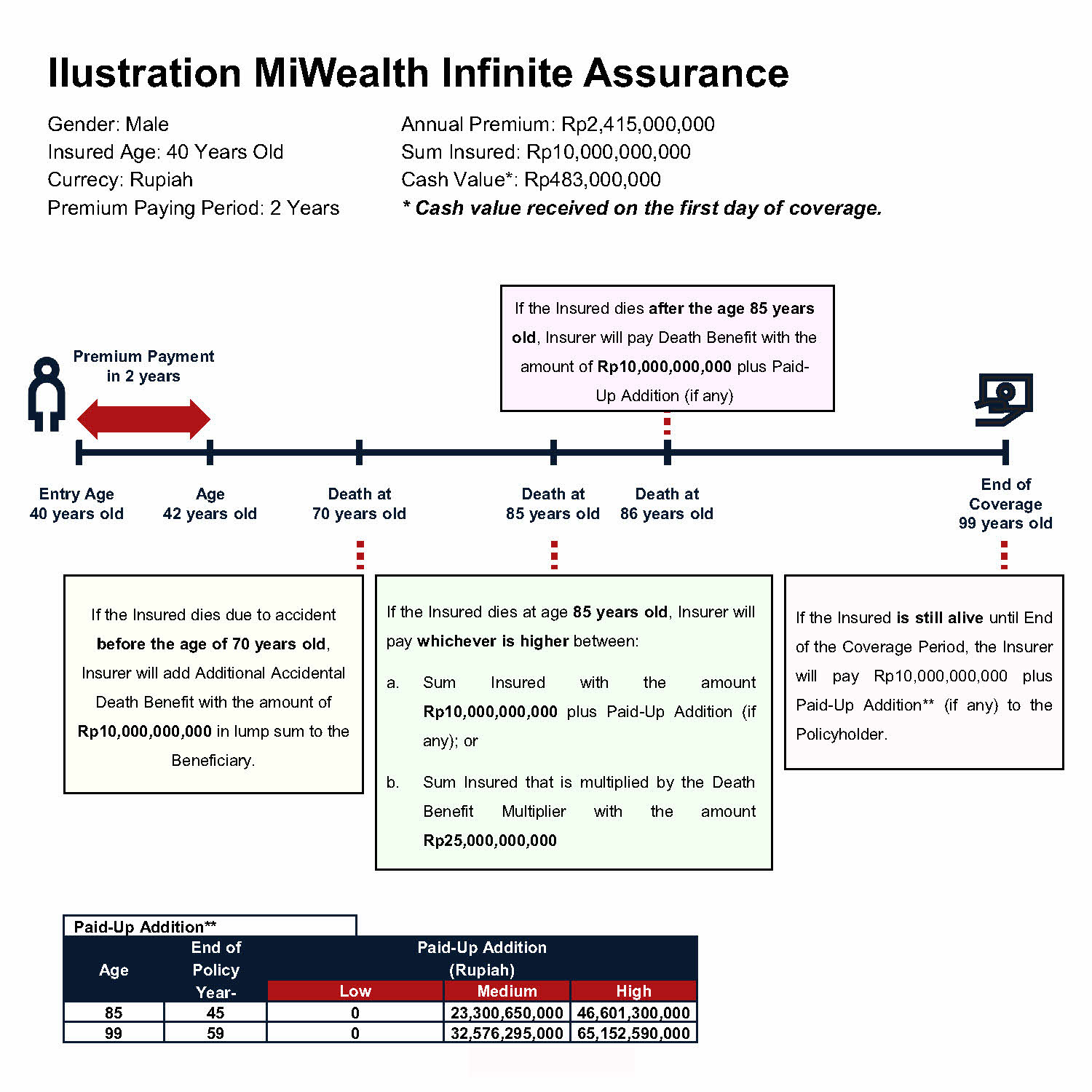

Death Benefit is 100% Sum Assured + Paid Up Addition (if any) or 100% Sum Assured x Multiplier Death Benefit**, whichever higher.

-

Additional accidental death benefit of 100% of the Sum Assured.

-

Maturity benefit of 100% of the Sum Assured + Additional Sum Assured (if any).

-

Paid Up Addition (if any) is a bonus whose amount is not guaranteed which will be added to the benefits insured.

Note:

*Up to the Insured 70 years old.

**Multiplier death benefit is a percentage of the Sum Assured that can be paid by the Insurer to the designated person if the Insured dies before or at the age of 85 years.

Find the Summary of Product and Service Information here.

Illustration

Costs

All fees charged to customers will refer to the provisions of the policy including but not limited to commission fees for the Bank.

Risks

Credit and Liquidity Risk

Policyholders will be exposed to credit and liquidity risk of PT Asuransi Jiwa Manulife Indonesia (Manulife Indonesia) as the risk selector of insurance products. Credit and liquidity risk relates to the ability of the Insurer to pay its obligations to its customers.

Risk of Early Termination of Policy

Early termination of the policy may result in the Policy Value being less than the benefits paid (if any) or the premiums paid and coverage will end.

Operational Risk

A risk caused by the failure or failure of internal processes, people, and systems, as well as by external events.

Foreign Exchange Rate Risk

Insurance policies in foreign currency will be exposed to Exchange Rate Risk if the Policy Holder/Designated decides to convert the insurance benefits into local currency where the value depends on the foreign exchange rate at that time.

IMPORTANT NOTE

MiWealth Infinite Assurance is an insurance product issued by Manulife Indonesia. This product is not a deposit product at Bank DBS Indonesia and therefore does not contain any obligations and is not guaranteed by the bank and is not included in the government guarantee program of the Deposit Insurance Corporation ("LPS").

Bank DBS Indonesia only acts as the party referencing this product where the use of logos and/or other attributes in brochures or marketing documents is only a form of cooperation between Bank DBS Indonesia and Manulife Indonesia so it cannot be interpreted that this product is a product of Bank DBS Indonesia.

PT Bank DBS Indonesia serta PT Asuransi Jiwa Manulife Indonesia berizin dan diawasi oleh Otoritas Jasa Keuangan (OJK).

Contact Us

Contact Us Our Relationship Manager will contact you for more further information.

Visit Us Find the nearest DBS branch in your town.

Quick Links

Need Help?

Talk to a DBS Expert

1 500 327 or

+6221 298 52800 (from overseas)

This number is not used for outgoing calls.

Or have someone contact us