At a Glance

Death or Total Permanent Disability Benefit

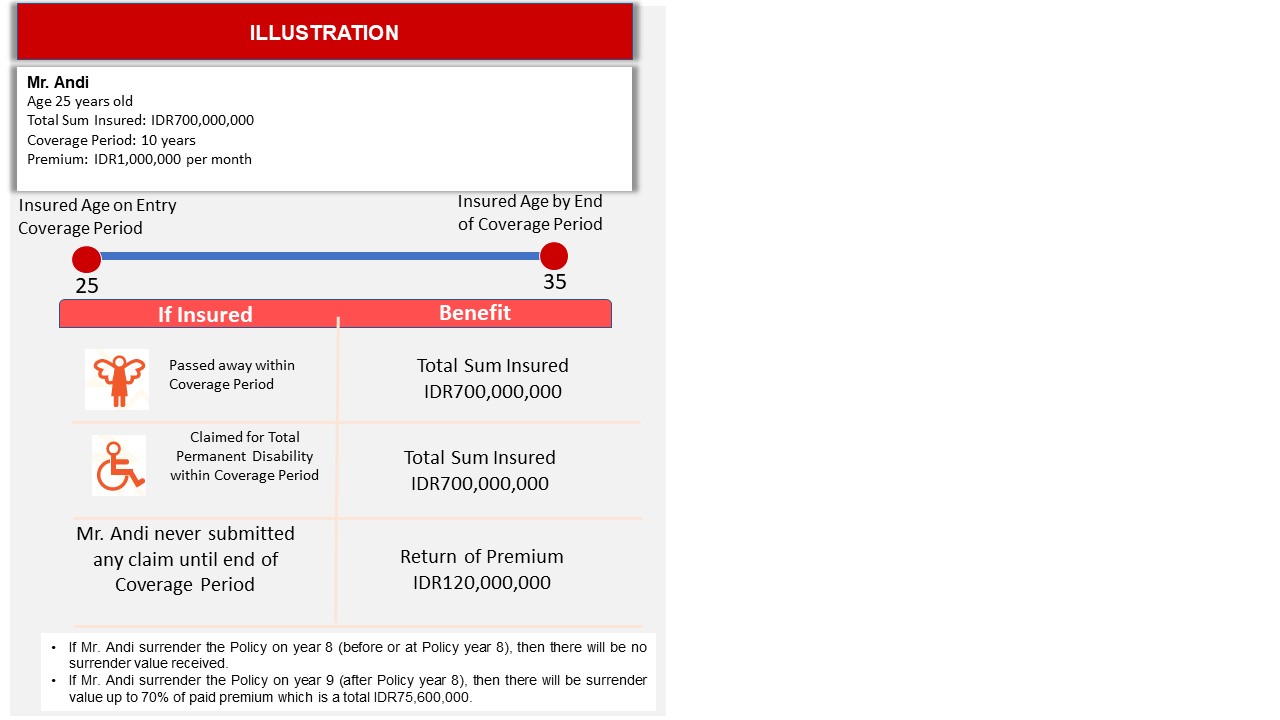

Death or Total Permanent Disability (TPD) Benefit up to 700 times monthly premium will be payable if the incident is caused by:

- Accident in the first Policy year; or

- Other reasons (natural cause/sickness) starting from second Policy year until the end of coverage period.

Maturity Benefit

The Insured is eligible to receive 100% of total premium paid in lumpsum as long as the Policy is still active by the end of coverage period.

Surrender Value

If the Insured surrender the Policy at or after the 8th Policy year, the surrender value is 70% of the paid premium.

Features & Benefits

-

Entry age starts from 18 - 50 years.

-

Coverage period starts from 8 - 15 years.

-

Flat premium starts from IDR50,000 - 2,000,000/month.

-

Sum Insured starts from IDR15,000,000 - 1,000,000,000.

The description of benefits listed on this page does not contain the full extent of MiFirst Life Protector. You are welcome to read the entire Policy Wording and Policy Schedule to find out the details of the benefits as well as the terms, conditions and the exclusions applied under this Policy.

Find the Summary of Product and Service Information here.

Illustration

Fees

The premium paid by the Insured includes the fee of service/return services to Bank DBS Indonesia of 25% in the 1st year, 15% in 2nd year and 5% in 3rd year (including tax) in the framework of MiFirst Life Protector products marketing.

All fees charged to customers will refer to policy provisions including but not limited to commission costs for Bank DBS Indonesia.

Risks

The Insured is not entitled to the benefits of this policy if the risk that occurs is included in the policy exclusions, both in special exceptions and general exceptions. If the Insured provides incorrect or wrong information, then PT Asuransi Jiwa Manulife Indonesia ("Manulife") can reduce or decline the claims submitted. This obligation has been attached since Insured submits request for insurance closure up to period of coverage ends.

IMPORTANT NOTE

MiFirst Life Protector is an insurance product published by Manulife. This product is not a savings product at Bank DBS Indonesia and therefore does not contain any obligations and is not guaranteed by Bank DBS Indonesia and is not included in the Government Insurance Program of Deposit Insurance Cooperation ("LPS").

Bank DBS Indonesia only acts as the party that referring this product where the use of logos and/or other attributes in the brochure or marketing documents is only a form of cooperation between Bank DBS Indonesia and Manulife so it cannot be interpreted that this product is a product of Bank DBS Indonesia.

PT Bank DBS Indonesia and PT Asuransi Jiwa Manulife Indonesia are licensed and supervised by the Financial Services Authority (OJK).

Quick Links

Need Help?

Talk to a DBS Expert

1 500 327 or

+6221 298 52800 (from overseas)

This number is not used for outgoing calls.

Or have someone contact us

.jpg)