At a Glance

Certainty of benefit until the end of the protection period

Provides guaranteed benefit up to 700%.

Accidental Death Benefit

100% Target Fund.

Premium Waiver Benefit*

Premium Waiver until the end of Premium Payment Period.

Easy underwriting process*

No medical examination required.

Features & Benefits

Product Superiority

-

Available in IDR and USD.

-

More varied target age options (ages 18, 25, 30, 35, 40, 45, 50, 55, 60, 65, 70).

-

2 optional of coverage benefit (from entry age up to 10 years or 20 years from Target Age).

-

Optional of Premium Payment Period (Single Premium, 3 years, or 5 years).

-

More complete protection with optional rider Advanced Life Protector Flex and Treasure Payor Benefit.

-

Entry age from 1 month up to 69 years old.

Main Benefit

-

Target Age Benefit. 100% of Target Fund will be paid at once when the Insured achieve target age.

-

Annual Cash Benefit. A total 200% or 400% of the Target Fund will be paid annually at 20% of Target Fund for 10 years or 20 years.

-

Maturity Benefit. 200% of Target Fund will be paid in one lump sum.

-

Return of Premium Benefit. Return of premium will be paid if the Insured dies within the first 2 years after Policy issued*.

-

Waiver of Premium Benefit*. Waiver of Premium Benefit will be paid if the Insured dies at premium payment period and after the first 2 years after Policy issued (only applied for Regular Premium).

-

Accidental Death Benefit will be paid 100% of Target Fund.

Notes:

* Terms & conditions apply.

Target Fund is sum of amount money that will be paid by the insurer in accordance to the provision in the policy.

Target Age is the age of the insured that is chosen by the policy holder to start receiving the benefit of cash payment.

Find the Summary Product and Service Information here.

Illustration

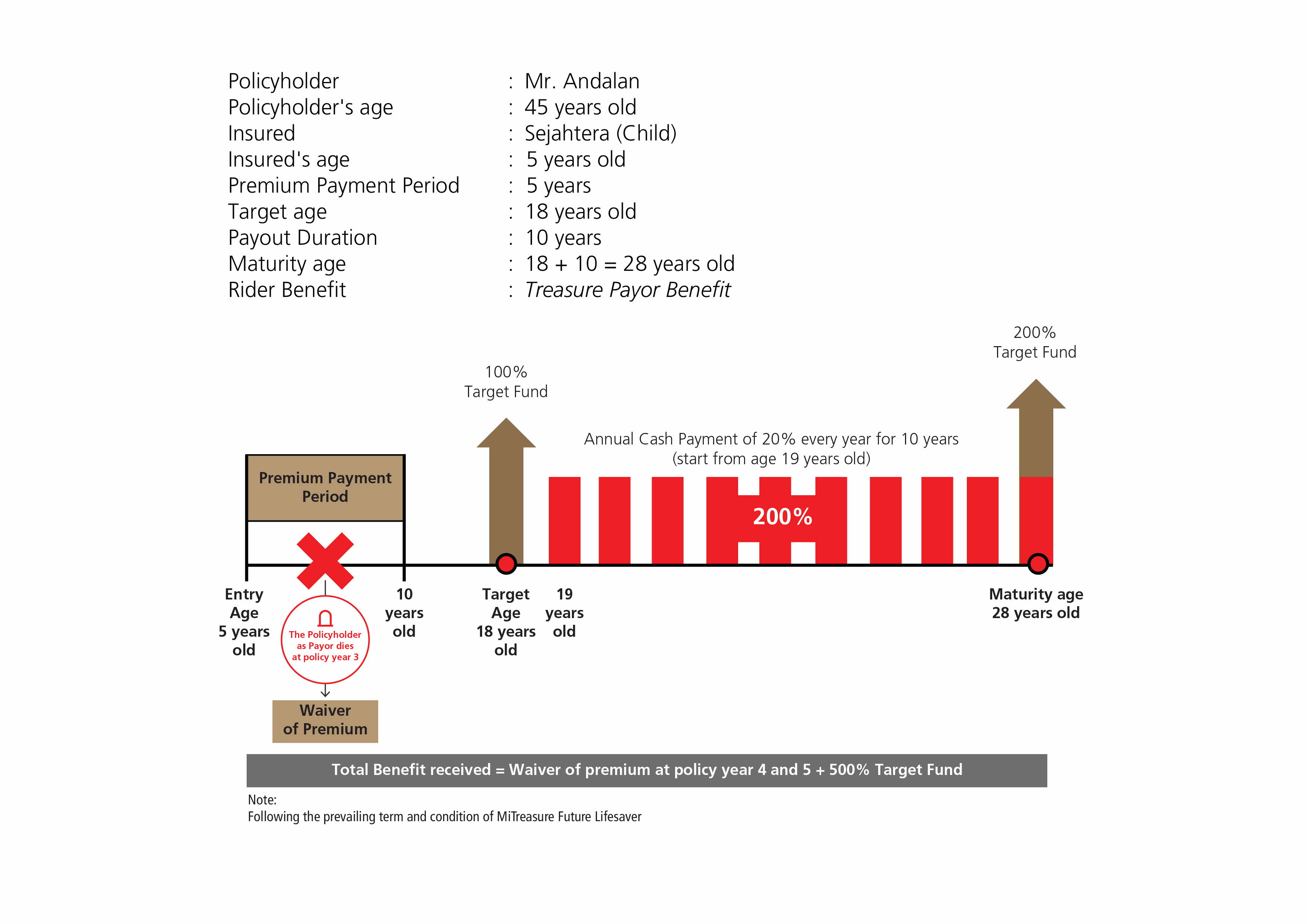

Scenario 1

Illustration with coverage period from entry age up to 10 years from target age.

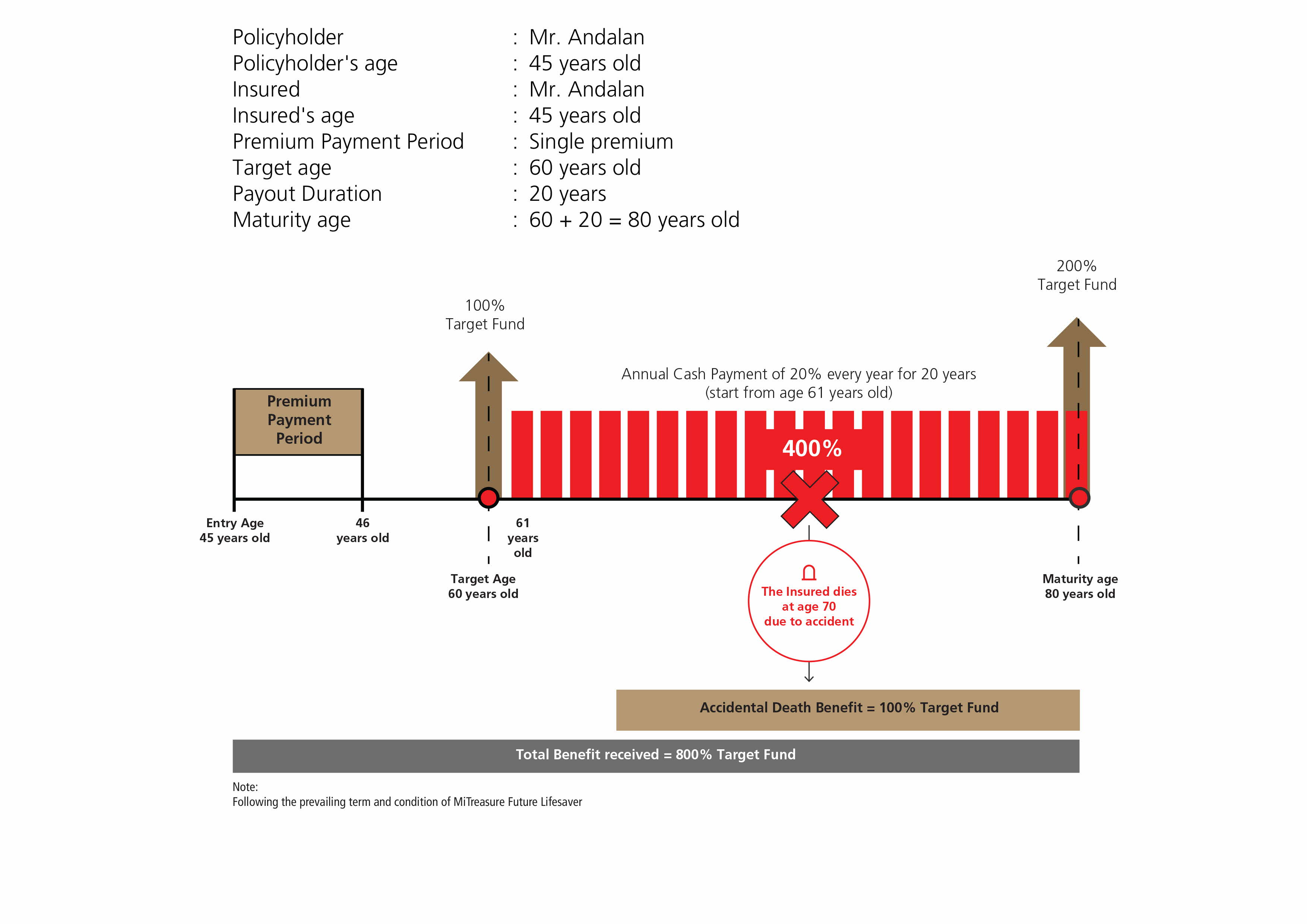

Scenario 2

Illustration with coverage period from entry age up to 20 years from target age.

Costs

All fees charged to customers will refer to the provisions of the policy including but not limited to commission fees for the Bank.

Risks

Credit and Liquidity Risk

Policyholders will be exposed to credit and liquidity risk of PT Asuransi Jiwa Manulife Indonesia ("Manulife Indonesia") as the risk selector of insurance products. Credit and liquidity risk relates to the ability of the Insurer to pay its obligations to its customers.

Risk of Early Termination of Policy

Early termination of the Policy may result in the Policy Value being less than the benefits paid (if any) or the premiums paid and coverage will end.

Operational Risk

A risk caused by the failure or failure of internal processes, people and systems, as well as by external events.

Foreign Exchange Rate Risk

Insurance Policies in foreign currency will be exposed to Exchange Rate Risk if the Policyholder/Designated decides to convert the insurance benefits into local currency where the value depends on the foreign exchange rate at that time.IMPORTANT NOTE

MiTreasure Future Lifesaver is an insurance product issued by Manulife Indonesia. This product is not a deposit product at Bank DBS Indonesia and therefore does not contain any obligations and is not guaranteed by the bank and is not included in the government guarantee program of the Deposit Insurance Corporation ("LPS").

Bank DBS Indonesia only acts as the party referencing this product where the use of logos and/or other attributes in brochures or marketing documents is only a form of cooperation between Bank DBS Indonesia and Manulife Indonesia so it cannot be interpreted that this product is a product of Bank DBS Indonesia.

PT Bank DBS Indonesia and PT Asuransi Jiwa Manulife Indonesia are licensed and supervised by the Financial Services Authority (OJK).Contact Us

Contact Us Our Relationship Manager will contact you for more further information.

Visit Us Find the nearest DBS branch in your town.

Quick Links

Need Help?

Talk to a DBS Expert

1 500 327 or

+6221 29852800 (from outside Indonesia)

Business Hours:

07.00 AM - 20.00 PM

Or have someone contact you