Changing Power and Powering Change

The automotive sector is in the midst of great change as motive power switches progressively from the internal combustion engine to electric. DBS, which is involved in financing this revolution in Asia, talks to TMI about its role in innovating across the supply chain, revealing lessons for all sectors.

The rapid acceleration in demand for electric vehicles (EVs) has numerous drivers, not least the desire to eliminate greenhouse gasses from our environment and the rise of new technologies that make EV adoption a realistic proposition.

Despite, or perhaps because of the massive global popularity of specialist racing series such as Formula E and Extreme E, the wider automotive sector has not been particularly well prepared, in production terms, to meet the enormous public enthusiasm for EVs.

If EV production is facing issues now, massive changes are needed urgently because estimates suggest that, by 2030, EV sales as a proportion of total global passenger car sales will rise to 48%. It was just 5% in 2018.1

With the pace of technological development likely to keep accelerating in parallel with consumer appetite for EVs, Joseph Lee, Global Head, Treasury & Working Capital Advisory & Solutioning, DBS, believes that the entire automotive sector supply chain needs to gear up now if it is to satisfy demand.

Shifting from ICE to EV

This may seem like a relatively simple challenge for an industry that for many years has thrived on well-honed production techniques. But in the face of a global pandemic, geopolitical instability, and economic uncertainty, the difficulties it faces are amplified. And, notes Lee, the change from the internal combustion engine (ICE) to EV has an entirely new (and substantial) cost-consideration: although there are only around 20 moving parts in an electric engine, compared with nearly 2,000 in an ICE, many are completely different.

Indeed, says Lee, while the complexity of the vehicle make-up reduces, cost reduction does not necessarily follow. The main reason for this is that EVs use some currently very expensive components. Of special note to the accountants are the battery and the electronic system that monitors and transfers power.

The relative newness of such components has seen a major supply chain disruption develop, Lee reports. Resultingly, unfavourable commodity price shifts have intervened, and even simple components such as computer chips have fallen into short supply. This is restricting the ability of some manufacturers to produce EVs in line with demand.

With the disruption and dislocation of the supply chain, factories in the automotive space have been forced to relocate and this creates uncertainty in terms of future location and connectivity of these facilities into the supply chain.

Increasing global footprint: new location considerations

“The future model, mindful of the disruptive geopolitical landscape, could see more factories built in Southeast Asia,” says Lee, noting that Thailand, Indonesia and Vietnam are prime candidates. However, most stakeholders know that the level of investment and time needed to ramp up production will be considerable. “The challenge now is for players to determine where EV factories will be built, and then how they will approach logistics for major components, to maintain ‘least cost-most efficient’ production.”

But challenges often create opportunities, and for EV production this bears out, particularly across Southeast Asia where in Indonesia, for example, nickel for battery production is plentiful. The wider region is also densely populated with a young and increasingly affluent demographic that will generate huge demand for EVs.

DBS sits astride a region where both EV production and demand is set to rise, comments Lee. China’s prominence in global EV sales is set to displace Europe as the market leader. An IHS Markit 2021 forecast predicts market shares of 44% and 28% respectively; it’s movement that should not be ignored.

Evolving EV-driven market opportunities will, on the manufacturing side, fuel increasing commercial changes such as new mergers and acquisitions (M&As), strategic alliances and joint ventures, alongside intensified research and development (R&D) and location options. New and innovative models of vehicle ownership will arise in the consumer space, as will service offerings, including battery rental and recycling.

It’s little wonder then that new overseas investment and activity in the region is growing. Hyundai has chosen Singapore as its EV Innovation centre, and has signed a memorandum with Indonesia for long-term investment in its EV manafacturing sector. Tesla is to set up its R&D centre in Bangalore, India. Traditional original equipment manufacturers (OEMs) in Taiwan have already started strategic alliances in response to supply chain disruption, and in India, Ola Electric has set out its plans to establish a global design centre for EV chassis production.

Traditional meets modern: working capital management solutions

The perfect storm of opportunity that is rising in Southeast Asia needs financial fuel to sustain it. But new opportunities don’t necessarily need a complete rethink of existing models, says Lee. Tried-and-trusted solutions can facilitate growth perfectly well, both in terms of EV development and market growth.

While production modelling techniques and sheer demand will eventually bring costs down, the need for automobile manufacturers and OEMs alike is for consistent funding of R&D, new production facilities and equipment, and the working capital required to sustain flows of inventory as production increases.

From a financing perspective, Lee believes that it will be vital for stakeholders to manage “a very lean working capital position”, where incoming cash is quickly ploughed back into vehicle development, production and sales generation on the one hand, and in ensuring attractive investor returns on the other.

“We have been helping our customers in the sector through solutions such as supplier finance, helping buyers extend payables, and suppliers release their receivables earlier, ensuring working capital flows are maintained.”

Supply chain finance (SCF) is a classic solution being applied in a very modern environment. As automotive OEMs are pressed into action to design and deliver new components to the automobile manufacturers, SCF becomes a vital component itself. It is, notes Lee, a means of sustaining the entire ecosystem of EV production, with suppliers reliant upon prompt payment to keep going.

“Plugging into the ecosystems of consumers, buyers and suppliers, and making an uninterrupted experience for all, is our goal"- Joseph Lee, Global Head, Treasury & Working Capital Advisory & Solutioning, DBS

“The move towards digitisation of trade and payments has stepped up in the past couple of years, and we have brought to our clients an evolving solution set,” comments Lee. The DBS roster of course includes its Supplier Payment Services offering; digitisation reducing supplier onboarding from two weeks to one day.

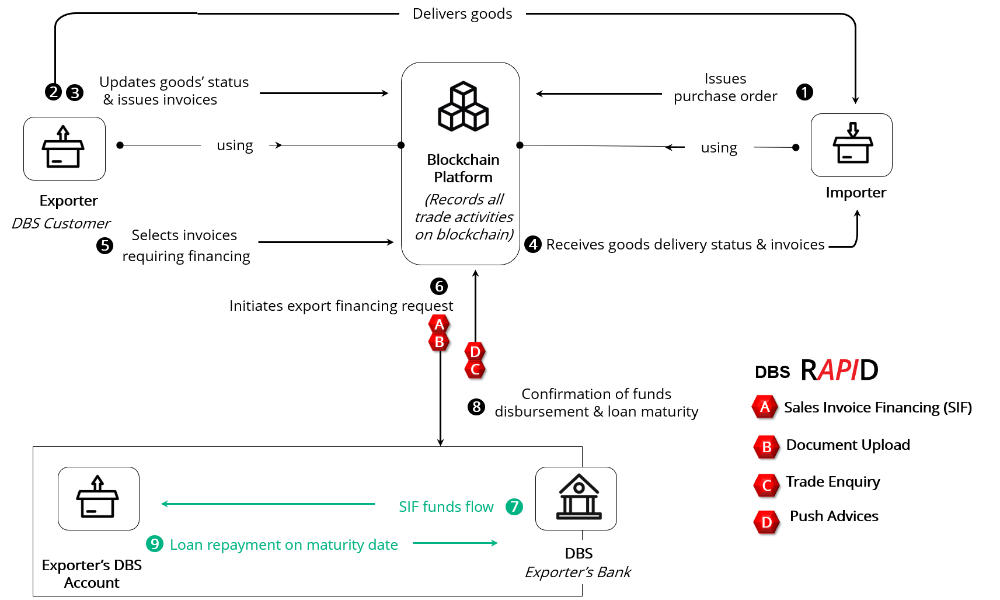

This is now supported by a blockchainbased traceability solution (see Fig 1 below) enabling “seamless and transparent” information exchanges and transactions end-to-end and in real time, helping to expedite payables and receivables processing, further boosting working capital management efficacy.

Figure 1

Working alongside the Monetary Authority of Singapore (MAS) and J.P. Morgan, DBS has also been exploring the use of blockchain as a means of enabling 24/7 settlement. This will start with a focus on facilitating flows primarily between Singapore-based banks in both USD and SGD, with the intent to expand coverage to other currencies, notes Lee.

For dealers and service centres, DBS offers an instant collection tool for loans. And, as new models of vehicle ownership roll out, its DBS MAX Client Integration suite aids micro payments (rental by the hour, for example), or subscription-based ownership. The bank can also provide a digital collections tool for use of EV-charging facilities.

Lee highlights the bank’s openness to working with independent SCF platform providers to help clients obtain financing. This, he feels, positions DBS as a key part of a progressively enriched ecosystem. “By participating, we are well placed to service any supplier or automaker in this region.”

He emphasises the bank’s regionality with good reason. Having established itself as a key player across Asia, he says that DBS has the depth of local knowledge, experience, and on-the-ground presence to support both major manufacturers and smaller businesses in the supply chain.

Crypto and cars: innovation model powered by digital ecosystem

The groundwork that DBS has already accomplished enables it to start introducing more customer solutions. Here, Lee underlines the bank’s explorations with cryptocurrency and digital assets.

As the number of digital currencies proliferate, including central bank digital currencies (CBDCs), DBS has set up a digital exchange – DBS Digital Exchange – becoming the first bank in Asia to provide a fully integrated tokenisation, trading and custody ecosystem for digital assets. DBS Digital Exchange offers trading services of four of the more established cryptocurrencies, namely Bitcoin, Ethereum, Bitcoin Cash and XRP (Ripple) against four fiat currencies (SGD, USD, HKD, JPY).

With fraud and compliance an everpresent challenge, members of the Exchange will benefit from DBS Group’s deep capabilities in multiple areas, such as the assurance of institutional-grade security and business continuity, robust governance and controls, as well as the bank’s extensive experience in providing custodial services. This, says Lee, is designed to “instil confidence”.

Its vision of payments has seen DBS exploring customer purchases of cars, related services (such as those referred to above) and other luxury goods. The prototype solution leverages the DBS ecosystem for ease of accepting Bitcoin as a settlement currency. The whole package is powered by application programming interfaces (APIs), affording real-time notifications for users.

The prospect for such a platform is exciting, says Lee, but is nonetheless tinged with wariness and a full understanding that Bitcoin volatility may not always make it the best payments option. DBS has been working with a brace of automotive sector players to tease out the needs of tomorrow’s industry, where digital currencies may well be accepted, and the impact this will have.

Figure 2

Powering change and sustainability with digital first

While the automotive sector’s shift towards EV is in itself supportive of sustainability, aspects of supply chain management such as traceability remain key.

DBS’ partnership with an automotive logistics client in China to tackle traceability is already in use. By using immutable data generated by the flow of produced goods, and which has been appended to a blockchain, the bank is able to offer finance to its client at appropriate stages. It does so with greater rapidity, and entirely without the risk inherent in the paper chain that would normally follow this process.

The shift towards more sustainable working practices facilitated by DBS through such technologies is a mark of how it has not been held back by weighty legacy systems. “Our cloud architecture allows us to innovate for our customers with greater agility” Lee explains. “We are constantly looking for more ways to offer seamless transactions, for example using robotic processing and artificial intelligence, because plugging into the ecosystems of consumers, buyers and suppliers, and making an uninterrupted experience for all, is our goal.”

In terms of assisting change in the automotive sector, this translates into direct connection with marketing, sales and consumer financing systems, all the way through to the receivables functions of the OEMs. If a car buyer can choose a vehicle from myriad options and secure funding in a matter of minutes, and manufacturers can deliver directly, the whole process becomes an opportunity for an entirely new holistic experience.

DNA reset

It’s an experience that Lee says is seeing diverse players, including technology firms, chip producers, energy providers and commodity producers, vying for position as the DNA of the automotive sector resets for the future.

With many other sectors facing upheaval as they strive to meet environmental targets while operating in the face of shifting supply chains and globally volatile economic conditions, the automotive sector may yet become the model for other sectors to follow.

One thing is certain, as they too start to blur the distinction between the old and new verticals that will deliver fresh opportunities, the support of a forwardthinking digital-first banking partner such as DBS will power change.

First published in Treasury Management International

- https://treasury-management.com/articles/changing-power-and-powering-change/

1Source - https://canalys.com/newsroom/canalys-global-electric-vehicle-sales-2020