Important Announcement

ATM charges applicable on your Treasures Account

Please note that your DBS debit card offers you free transactions at all ATMs until 15th May 2017. Post 15th May 2017, transactions at non-DBS ATMs is limited to 5 free transactions in a month. There will be a charge of Rs 20 per transaction beyond the free transactions. For the list of DBS ATMs, click here.

Seeding of Aadhaar number in Bank Accounts

Please note that DBS Bank India has the option of registering your Aadhaar Card number in its banks records. In case you have not provided the details earlier and wish to update the details, please submit the request to your nearest DBS branch. Kindly call us on 1800 209 4555 if you have any queries.

Important regulatory information for DBS iBanking and mBanking customers

As per Ministry of Finance guidelines, quoting of PAN number is mandatory for all financial transactions through Branch/Online (iBanking and mBanking).

Request you to update your PAN card number with the Bank on an immediate basis (if not updated already).

General Announcements

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account.

As per guidelines issued by Reserve Bank of India, w.e.f September 1, 2015 NEFT/RTGS will not be operational on 2nd and 4th Saturdays of the month and will operate full day on 1st, 3rd and 5th Saturday (if any).

Related Links

- Service Charges & Fees

- Banking Forms

- Research

- Terms & Conditions

- Cheque Collection Policy (PDF)

- Compensation Policy (PDF)

- Service Guide

- Citizens Charter (PDF)

- Time Norms

- Banking Ombudsman FAQ

- Know Your Banknotes

- Code of Bank's Commitment to Customers

- RBI Circular on Fictitious Offers of Cheap funds from Abroad

- DBS Deposit Policy

- BCSBI Newsletter

Frequently Asked Questions

t's tough being away from home, where your loved ones are. DBS Remit is now giving you a peace of mind with free medical concierge services designed to assist your loved ones in India when help is needed. Fulfill a few simple requirements to be eligible for the promotion.

Enjoy the free medical concierge services in 4 simple steps:

| Step 1 | Step 2 |

|

|

| Share the promo code "DBSCARE" with your loved one in India and ask them to install DBS digibank app from India Google Play or Apple app store. | Your beneficiary in India can then open the DBS digibank India account using the promo-code "DBSCARE". |

| Step 3 | Step 4 |

|

|

| Transfer a minimum of S$3,000 to the newly opened DBS digibank India account. Please enter the promo code "DBSCARE" during the transfer. | Ensure your loved one maintains INR 50,000 in the first two months to qualify for one year's free medical concierge services. |

Here are some of the benefits your loved ones will enjoy from this service in India:

|

|

|

|

|

|

|

|

|

DBS Remit India Care

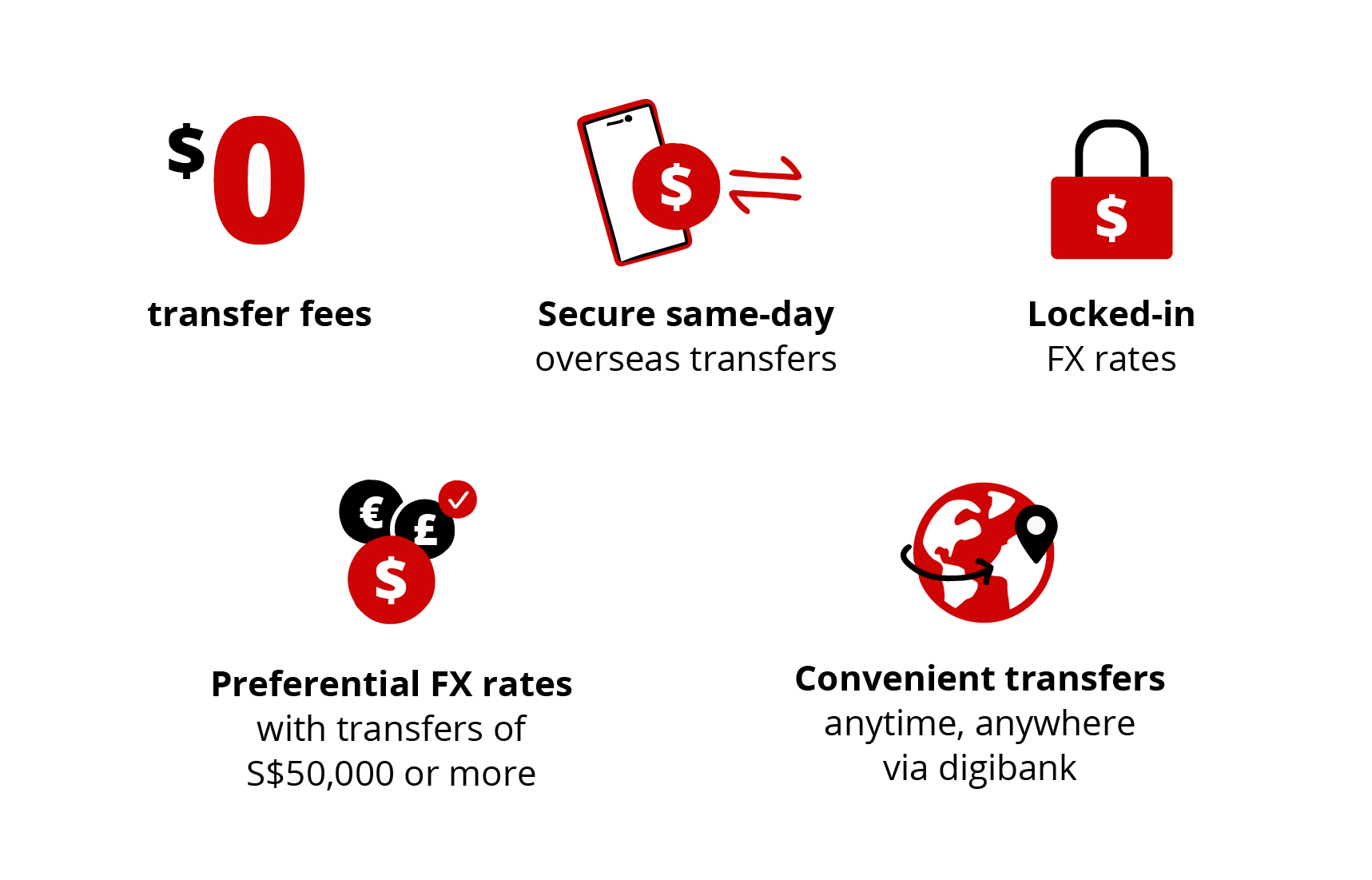

Overseas Funds Transfer & Remit At a Glance

Same-day transfers at $0 fees when you transfer money online to Australia, China, Eurozone countries, Hong Kong, India, Indonesia, Malaysia, Philippines, UK and USA.

And that's not all. You'll enjoy:

How to Transfer

Get started now:

- Login to iBanking

- Choose the country and currency for remittance

- Enter the amount to remit (min S$1,000 to use FX Watch feature)

- Select the 'FX Watch' checkbox, enter your preferred FX rate and when you want to transfer by

Quick Links

Need Help?

Talk to a DBS Expert

1 500 327 or

+6221 29852888 (from outside Indonesia)

Business Hours:

07.00 AM - 20.00 PM

Or have someone contact you